This article talks about Why the latest Bank of Canada interest rate increase is small potatoes

Just released on May 29, 2006

Since February 2005, TD Economics has forecast that a rebalancing in monetary policy would see the Bank of Canada raise its benchmark overnight rate to a peak of 4.00% in mid-2006. We stuck to this call for 15 months. However, the communiqué accompanying the April rate hike - which lifted short-term rates to our 4.00% target -suggested that the Bank was still leaning toward pulling the trigger one more time, and it delivered with a quarter point increase last week. If we had been conducting policy, rates would have been left on hold. But, like most sore losers, we’ll now argue that the last hike is no big deal.

The central bank’s latest decision has sparked a considerable amount of criticism, most of which is a bit unfair. The focus has been on the fact that rates have been increased seven times in a row, that the increase in borrowing costs has eroded housing affordability, and that rate increases have contributed to the strength in the Canadian dollar. A more sober assessment reveals two important observations: First, it is the level - not the change - in interest rates that is of critical importance to the economy. Second, the interest rates actually faced by consumers have not moved to the same degree as the Bank’s overnight rate. When these two observations are taken into consideration, it is evident that there is nothing especially damaging about the current conduct of monetary policy and while we would have stopped at 4.00%, the extra 25 basis points won’t break the economy.

It’s all about the level

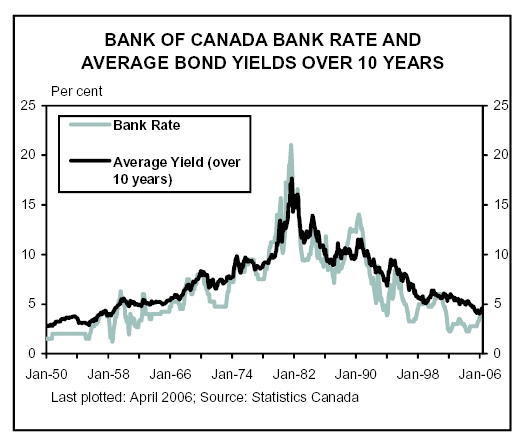

The Bank of Canada’s decision to raise rates one further time is largely innocuous because the level of interest rates across the yield curve is very low by historical standards. Despite the removal of 175 basis points of stimulus, the overnight lending rate sits at a very modest 4.25%. Using the Bank Rate as a guide, the policy rate has fallen over this cycle to a level not seen since the late 1950s. You would also have to go back that far to find the last time that longer maturity yields displayed the levels seen recently. After removing the effect of inflation, the real interest rate based on 3-month Treasury yields has fallen during this cycle to levels last seen during the late 1970s.

The Bank has been able to keep their lending rate so low because they have been very successful in their mandate of low and stable inflation, and in the process, have grounded inflation expectations. While increased transparency and enhanced credibility of the Bank has played a role in keeping inflation subdued, the emergence of China and India has also contributed to falling prices for many manufactured goods and textiles. The sharp appreciation of the dollar, motivated in large part by surging commodity prices, has also put downward pressure on imported goods and has allowed the Bank to temper the pace of tightening.

Does the overnight rate matter…

The Bank of Canada’s overnight rate is just one of a myriad of interest rates and one that Canadians will never directly face. Meanwhile, the rates that consumers typically borrow at have increased much more modestly than the overnight rate. This becomes increasingly apparent for interest rates at longer maturities, leaving the overall yield curve extremely flat. Since the Bank started tightening in September of 2005, 5 year Government of Canada yields have increased by 84 basis points, while the 10 year and the long-term benchmark have increased by just 72 and 23 basis points, respectively. Meanwhile, the five-year conventional mortgage rate has risen by 95 basis points.

Typically, changes in the overnight rate are reflected in prime rates charged by Canadian chartered banks, which then feed through to variable rate mortgages and other consumer loans before moving out over the remainder of the yield curve. Historically, the overnight rate has played a large role in the overall shape of the yield curve, as market participants assessed the future path of interest rates.

However, more recently, other factors such as high pension demand for longer maturity bonds and a glut of global savings have leaned on the long-end, depressing rates below what would normally occur. This was former-Fed chairman Greenspan’s famous “conundrum” characterization. Furthermore, the diametrically opposite fiscal performance in Canada and the United States has also exerted downward pressure on domestic yields at longer maturities, adding to the low long end of the yield curve.

… for housing affordability?

The housing market is a case in point of where there is a disconnect between the rates that borrowers face and those set by the Bank of Canada. While variable rate mortgages move in lockstep with the prime lending rate, which itself is tied to changes in the overnight rate, fixed rate mortgages generally track developments in the bond market. For example, 5-year fixed rate mortgages will follow 5-year government bonds. As noted above, even though the Bank has raised their policy rate by 1.75% since the fall of 2005, longer maturity yields, including mortgages, have not shown the same rate of increase.

The criticism raised against the Bank for causing a deterioration in affordability, while partially correct in spirit, has come a bit late. If anything, the modest rise in mortgage rates will help keep affordability in check. The true cause of declining affordability is the rapid growth rate in home prices, a trend set in motion by the massive dose of monetary stimulus administered by the Bank during the economic slowdown of 2001.

… for the Canadian dollar?

And what of the criticism that the Bank of Canada’s tightening cycle has pushed the dollar higher? While there is little doubt that the speed at which the Canadian dollar has appreciated is worrisome, especially for the manufacturing sector, the role that the Bank has played in fuelling the rise in the loonie is minor. The rise of the dollar is mostly due to a combination of soaring commodity prices and the continued weakness displayed by the U.S. currency. In fact, the spread between Canadian and U.S. interest rate continues to favour the United States as the pace of the tightening cycle in Canada has been eclipsed by that of the United States. So if anything, the interaction between monetary policy in Canada and the United States has placed downward pressure on the value of the dollar. However, it is important to recognize that empirical studies have noted that the channel between domestic interest rates and the value of the dollar is fairly small.

Global Insight estimates that a permanent 100 basis point increase in the Canada-U.S. interest rate differential results in a 2.8% appreciation in the Canadian dollar by the end of two years. Applying this relationship to the last two years suggests that in order to have kept the Canadian dollar around the U.S. 85 cent level that prevailed in September 2005, the Bank would have had to freeze their key policy rate at the rock bottom level of 2.5% while the corresponding U.S. rate rose to 5.0%. This is clearly one case where “everything else would not have been equal”. In the environment of robust Canadian economic growth, inflation pressures would have risen enormously with the greatest impact likely in housing markets, resulting in an even greater deterioration in affordability than has actually occurred.

Conclusion

The main message is that it is the level and not the change in interest rates that is important for economic activity. Despite the seven rate increases by the Bank of Canada, the level of the overnight rate remains fairly low. And, it is not just the level of the Bank’s benchmark overnight rate that matters, but the level of market interest rates across the entire yield curve that determines the borrowing cost for consumers and businesses. On this front, interest rates across the yield curve are not significantly restrictive. The big news is that it appears the Bank is set to pause, and despite the fact that they are set to do so at a rate that is 25 basis points higher than what we had predicted, we firmly believe that it is the prudent decision at this juncture.

Used with permission: Paul Chadwick from TD-CT

For more information please contact Mark Argentino

A. Mark Argentino Associate Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS 905-828-3434

FAX 905-828-2829

E-MAIL mark@mississauga4sale.com

Website: Mississauga4Sale.com

No comments:

Post a Comment