Tuesday, January 16, 2007

Wednesday, January 10, 2007

Why are the months of January and February 2007 a good time to sell my home?

The reason that January and February are good months to sell your home or property is because the competition is far lower compared to other times of the year. This means that you may be able to set your asking price at a healthy amount and since there is so little competition, you may find that you receive a good offer under your terms and conditions.

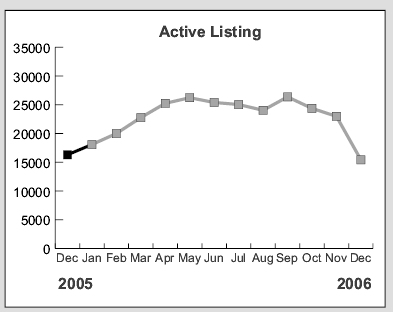

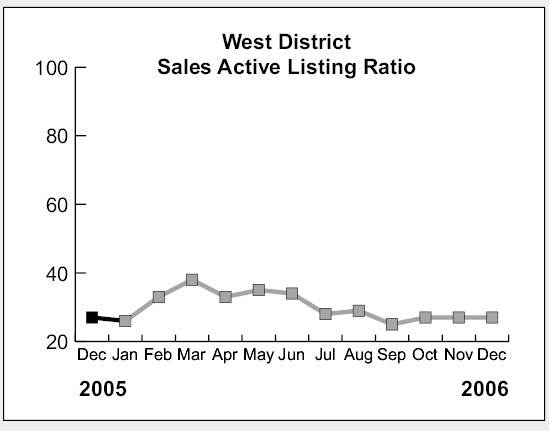

See the graph below showing the number of active listings is at it's lowest amount of the year. Also listings to sales ratios at the chart below and note that the number of listings is down.

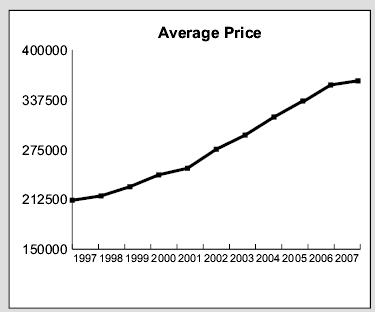

Prices are at historic levels, good time to sell, see the graph below

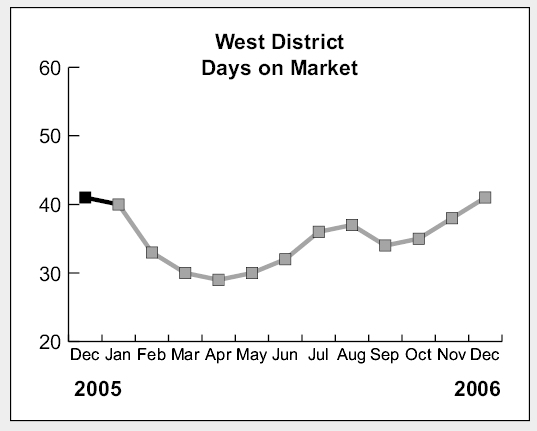

Time on the market is shown on this graph and you will note that in January and February the days on the market plummets, meaning that it's still a good time of year to sell.

Sales to active listings also increases dramatically in January and February

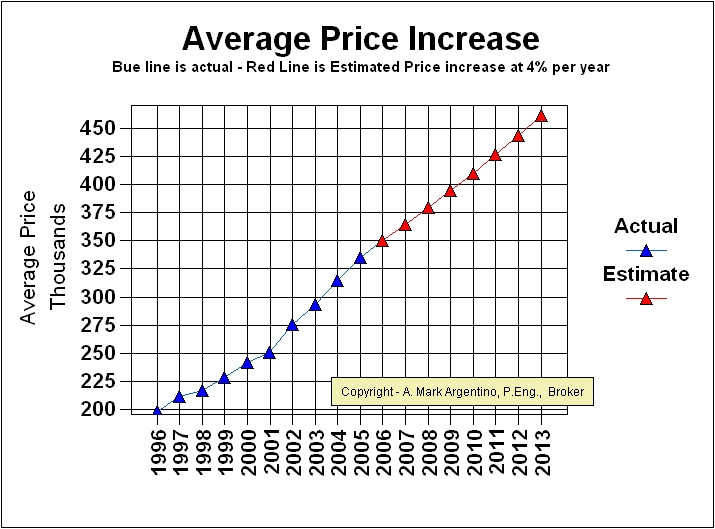

See a graph of the average prices over the past 15 years.

Graph of TREB Prices

The average single family residential price increased the following amounts in the past few years

The table above shows that prices have increased steadily since 1997, nearly 10 years of unprecedented growth. These figures give an overall trend of the average prices of single family residential prices in the Toronto and GTA marketplace.

Of note is the fact that although the central core prices of real estate have escalated at a much higher rate than the values above. TREB (the Toronto Real Estate Board) has continued it's expansion of MLS boundaries and therefore the average prices above take into account cities and towns that are much further out from the core that have much lower average prices compared to the city core. This shows how great of an impact the high prices in the central city have on the overall price. I don't know exactly how many kilometers of outward growth that TREB experienced over the past 10 years, but I would guess that at least tens of thousands of new properties have been taken into account when calculating the year over year figures.

If prices from 2007 for the next 5 years were to increase at an annual rate of 4% then the average price would be over $460,000 in 2013. The graph below shows this estimated price increase.

Below is a Graph showing TREB Historical Average Price Data

- The graph below shows a graph of sales price data obtained directly from the Toronto Real Estate Board showing the average selling price of single family homes from 1985 to date in our GTA marketplace.

- Note the historical trends for spring and fall price increases, where spring typically has a larger increase compared to the fall.

- The benchmark for changes in price is chosen to be the average price of homes at the last height of the market, which was $273,698 in 1989.

- If you want the actual values of prices for every month going back to January 1995, I have them, and would be pleased to E-mail them to you upon request.

- See the Average Price Cycles from January 1995 to Date - a very interesting cyclical pattern is clearly seen!

- You may also see the average mortgage interest rates back to 1979

- Send Mark a request for the actual prices of homes since 1995 or you can call Mark now at 905-828-3434

- Open the graph below in a new separate window

For more information please contact A. Mark Argentino

A. Mark Argentino Associate Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS 905-828-3434

FAX 905-828-2829

E-MAIL mark@mississauga4sale.com

Website: Mississauga4Sale.com

Monday, January 08, 2007

January 2007 Toronto Real Estate Board Press Release for last year - 2006 Ends On a High Note

The Toronto Real Estate Board (TREB) issued a January 2007 Press Release regarding average prices and volumes for last year - bottom line: 2006 Ends On a High Note

Year over Year Average Toronto Price up 5% for 2006

TORONTO, January 4, 2007 --

TREB Members reported 4,447 sales in December, up four per cent over the 4,255 recorded last December, and the second best total ever recorded for the month, TREB President Dorothy Mason announced today. "December's performance is indicative of the whole year, which saw total transactions break the 83,000 level (83,084) for only the third time since records have been kept," noted the President.

Year-over-year, the average price in 2006 rose five per cent over the $335,907 recorded in 2005 to $351,941. "This means that prices continue to outpace inflation, making home-ownership a sound investment in today's economy and invariably in the long term."

Breaking down the total, 1,643 sales were reported in TREB’s 28 West districts and averaged $318,364; 779 sales were reported in the 14 Central districts and averaged $408,599; 941 sales were reported in the 23 North districts and averaged $382,065; and 1,084 sales were reported in TREB’s 21 East districts and averaged $271,463.

Side Note from Mark: The average price increased in 2006 by 5%. The average price increased 7% in 2005.

This is the official press release from the Toronto Real Estate Board

Year ends with a strong December

TORONTO, January 4, 2007 -- Resale housing activity in December increased by four per cent compared to the same month a year ago, Toronto Real Estate Board President Dorothy Mason announced today.

“All year long the market has remained very stable,” Mrs. Mason said. “December’s strong showing gives consumers even more confidence that there is a solid foundation in place as we begin the new year.”

The elevated activity at the end of the year helped propel 2006 to within just 1.2 per cent of the record sales total set in 2005.

Jason Mercer, CMHC’s Senior Market Analyst for the GTA, argued that a strong economy is behind the upbeat performance: “Households remained confident in their ability to purchase a home last year,” said Mr. Mercer. “Furthermore, steady job growth in a number of different sectors and very low mortgage rates will keep buyers upbeat about home ownership in 2007."

In Don Mills (C13), 54 per cent more overall transactions took place during the month compared to last December, fueled in part by strong condominium activity.

A 54 per cent increase in overall sales was recorded in Etobicoke’s South Humber neighbourhood (W07), also helped by elevated condominium transactions.

East of Toronto, Pickering (E13) showed an overall sales increase of 30 per cent compared to December 2005, while in West Markham / Langstaff (N01), strong condominium sales led to a 63 per cent increase in overall transactions during the month, compared to a year ago.

“The market is on solid footing and is in excellent shape heading into 2007,” TREB’s President said. The winter season is an excellent time to be active in this healthy market, whether starting out as a first time buyer or making a move to a different home.”

For more information please contact A. Mark Argentino

A. Mark Argentino Associate Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS 905-828-3434

FAX 905-828-2829

E-MAIL mark@mississauga4sale.com

Website: Mississauga4Sale.com

Wednesday, January 03, 2007

Fire Safety comes first at Christmas and all year!

Family Fire Safety in the home.

Family Fire Safety in the home.This article is slightly late since Christmas is now over, but it never hurts to go over fire safety and a plan for your family in the event of a fire.

Safety comes first at Christmas

Here are some tips to protect your family from fire this Christmas.

Install smoke detectors in your house, condo or apartment. It can save your life. Install at least one on each level of your home, on the ceiling or high on the wall and outside each sleeping area.

Test smoke detectors at least once a month and dust the grill work on the device. Replace the batteries twice a year. A good way to remember is to change them when you change your clocks in the spring and fall. Replace any alarm that is more than 10 years old.

Familiarize children with the sound of the alarm. Discuss what to do if the alarm goes off. Each family member should be able to hear it from their bedroom. Test the alarm at night to ensure everyone wakes up.

Families that sleep with their bedroom doors closed should have a qualified electrician install interconnecting alarms, so if one sounds, they all sound.

Carbon monoxide is a deadly odourless, colorless gas. Install at least two carbon monoxide detectors and place them in hallways near bedrooms and in the basement.

Create a fire escape plan. Draw a diagram of your house or apartment, marking all windows and doors. Plot two routes out of each room.

Designate a meeting place outside where everyone will gather, such as a spot on the front lawn, near the mailbox or at the end of the driveway.

Practise your escape so that every family member will know what to do. Some experts suggest that you practise at least twice a year.

Always assume that the sound of a smoke alarm indicates a real fire. You should be prepared to follow your escape plan.

Leave your home immediately and join family members in the designated meeting place. Leave belongings behind and call the fire department from a mobile phone or neighbour's house after you're safely out. Once you're out, don't return for any reason.

Smoke and heat rise, so it's important to crawl, not walk, from a burning building.

If a fire breaks out while you're in bed, don't sit up. Instead, roll out of bed and crawl on the floor, staying below the heat and smoke. Feel the door with the back of your hand. If the door or knob is hot, don't open it.

Put matches, lighters and candles in a high, locked cabinet so they are out of sight and reach of children.

If you smoke, use deep ashtrays and drown cigarettes with water before throwing them out.

and remember to "Clean Your Chimney For Santa"

This article is courtesy of: Paul Schuster aka the "Fire Guy"

73 Gray Cres. Richmond Hill Ont. L4C 5V4 (905) 884-4423

For more information please contact A. Mark Argentino

A. Mark Argentino Associate Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS 905-828-3434

FAX 905-828-2829

E-MAIL mark@mississauga4sale.com

Website: Mississauga4Sale.com

Tuesday, January 02, 2007

Canadian Economy Stalls in 4th Quarter - TD Canada Trust Reports

HIGHLIGHTS

Data confirm Canadian economic slowdown in Q4

U.S. PPI and housing starts bounce up, but not a trend

Investing themes for 2007

There was no holiday cheer in this week's Canadian economic releases. The Scrooge-like data revealed that the economy ground to a halt as it entered the fourth quarter of 2006. After contracting by 0.4% in September (revised from -0.3%), the economy disappointed expectations for a rebound and posted absolutely no growth in October.

Canadian economy struggles in Q4

From a sectoral point the news was as depressing as visits from the ghosts of the past, present and future. Manufacturing output contracted 0.8% in October, marking a ninth monthly decline for the year. This dismal out-turn was far from surprising and there is little hope for a Christmas miracle that will turn things around any time soon. For an in-depth discussion of the challenges facing manufacturers please refer to the report released this week entitled "Pressure Makes Diamonds: A Road Map for Canadian Manufacturing".

Looking beyond the beleaguered manufacturing sector, there were signs of weakness in several other areas. Transportation and warehousing also posted a significant decline in October, but this is likely tied to the suffering in manufacturing and reflects the impact of a slowing U.S. economy on Canadian exports.

More eye-opening was news of slower growth in some service sectors. Wholesale trade edged down 0.2% in October, marking the first back-to-back monthly decline in two years. The story was the same in retail, where sales fell 0.7% in October, building on a 1.2% decline in September. Worse still, the weakness in retail shifted from being largely an auto story to being broadly based, with ex-auto sales down 0.7% in October. And, these results were not caused by price effects. The volume of wholesale trade dropped 0.8%, while retail contracted 0.5%.

This puts the Canadian economy on a particularly soft footing in the fourth quarter. For example, if the economy posted a 0.3% rebound in November and 0.2% advance in December, both of which are well within the realm of possibility, real GDP at basic prices in the fourth quarter would come in at 0.3% annualized. While Governor Dodge has gone on record as saying that economic growth will likely disappoint the Bank of Canada's forecast of 2.8%, it is unlikely that the central bank was anticipating the possibility of virtually no growth in the final three months of the year. To be fair, we would also be extremely disappointed, since our projection was for a gain of 1.8%.

Having said all of that, there is a very good chance that economic growth will come in higher than the monthly data are suggesting. The monthly real GDP at basic prices is not always a good predictor of what the quarterly national accounts show in terms of real GDP on an income and expenditure basis, because the latter factors more directly trade flows and inventory fluctuations. There is also a good chance that economic growth will surprise on the upside in November and December. We think the weakness in retail activity is a bit odd, particularly given the strong fundamentals of low unemployment, rising real personal income, modest interest rates and high consumer confidence, which should make for robust consumer spending. For a complete explanation of the economic outlook see The Quarterly Economic Forecast released on December 19th.

So, the main message is that the data confirm that the Canadian economy has definitely shifted down a gear and economic growth could fall well short of our initial 1.8% projection in the fourth quarter. However, this out-turn only adds to our view that the current economic slowdown will force the Bank of Canada's hand and lead to rate cuts in the spring. It is also consistent with our view that the Canadian dollar will remain range bound near current levels, as deteriorating domestic economic conditions and expectations for rate cuts will limit the ability of the loonie to benefit from weakness in the U.S. dollar.

Mixed U.S. data don't alter assessment of slowdown

The U.S. data painted a very mixed picture this week. Markets received a shock when it was reported that the Producer Price Index shot up 2.0% in November and housing starts surprised on the upside with an increase to 1588 thousand units. The knee jerk reaction from many pundits was that inflation remained a risk and the worst is behind U.S. real estate.

We don't subscribe to either of these views. First, there is a very weak relationship between producer and consumer prices. This was confirmed on Friday with the report that the core Personal Consumption Expenditure (PCE) deflator - the U.S. Federal Reserve's preferred measure of inflation - was unchanged in November and the year-over-year rate fell two-tenths of a point to 2.2%. Second, we still believe that there is one to two more quarters of weakness to come in real estate.

And, while the consumer is hanging in much better than we anticipated, with personal expenditure rising 0.5% in November, we continue to believe that the housing correction will act with a lag, dampening spending in the new year. Moreover, the recent strength on the consumer front is being offset by softer business investment. Although a 1.9% increase in overall durable goods orders in November looked good, the more important core capital goods orders that are a leading indicator of business investment contracted 1.4%.

Investing themes for 2007

The bottom line is that the U.S. and Canadian economies are in the midst of an economic slowdown, with the pace of expansion running well below their long-term potential rates of 3.3% and 2.8%, respectively. As this continues over the next two to three quarters, the resulting accumulation of economic slack will diminish the price pressures present and cause financial markets to anticipate central bank rate cuts, which we believe will arrive in the spring. However, this is unlikely to lead to a significant rally in the bond market, which has already priced in much of the forthcoming weakness. It is also not expected to spark a major correction in commodity prices, although crude oil and base metals could give up some of their gains in the near-term. Equity markets in both the U.S. and Canada may face headwinds from slowing profit growth, but they will be forward looking and should anticipate strong economic conditions, particularly when the central banks start telegraphing rate cuts. And, with those investing themes for 2007, TD Economics wishes readers all the best for the holidays and in the New Year.

Article courtesy of R.Paul Chadwick Manager of Residential Mortgages,TD Canada Trust

For more information please contact A. Mark Argentino

A. Mark Argentino Associate Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS 905-828-3434

FAX 905-828-2829

E-MAIL mark@mississauga4sale.com

Website: Mississauga4Sale.com

Thursday, December 28, 2006

Happy New Year 2007!

A. Mark Argentino Associate Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS 905-828-3434

FAX 905-828-2829

E-MAIL mark@mississauga4sale.com

Website: Mississauga4Sale.com

Thursday, December 21, 2006

Technorati assistance was awesome! Here is a great person to contact if you have a claim problem.

Here name was

Best Regards,

Janice Myint

Customer Support Specialist

Technorati

and her blog can be found at http://janicetechnorati.blogspot.com/

For more information please contact A. Mark Argentino

A. Mark Argentino Associate Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS 905-828-3434

FAX 905-828-2829

E-MAIL mark@mississauga4sale.com

Website: Mississauga4Sale.com

Wednesday, December 20, 2006

Canadian Inflation Eases, Retail Sales Boom, Future looks Good for Real Estate

-Fed remains on hold as retail sales boom and inflation eases

-Canadian international trade and manufacturing

-Shipments weak while productivity puzzles

It may be that the easiest job in the world this week belonged to the statement writer for the Federal Open Market Committee (FOMC) who added just a handful of words to the previous missive (the most significant of which were the that the housing market is seen now as “substantially” cooling and that some of the recent economic indicators have been “mixed”). Despite our efforts to turn this molehill into a mountain (see our commentary), there was not a great deal to glean from the Fed other than maintaining the status-quo. By contrast, the economic data released this week offers a better, although indirect, window into the Fed’s thinking.

Arguably the single most important piece of U.S. economic data these days is the retail sales report, as it will provide the first indication that the correcting housing market has begun to restrain consumer spending. Here the news was shockingly positive, as retail sales in November trounced the market expectations by rising 1.0%. It is equally encouraging that the gains were broadly based. The ex-autos and gasoline measure rose by a strong 0.9%. Even October’s worrisome 0.4% decline was revised higher to a relatively more benign fall of 0.1%. From the perspective of the Fed, the greater momentum in consumer expenditures reinforces their case to remain on hold for the time being in hopes that the retrenchment in the housing market remains well-contained, leading the overall economy to a coveted soft-landing.

Meanwhile, this morning’s CPI report likely generated a measured sigh of relief at the Fed as core inflation surprised the market and eased by a tenth of a percentage point to 2.6% in November. Even though core inflation remains above the Fed’s comfort zone, the three-month annualized trend stands at an extremely reasonable 1.6% despite the fact that shelter costs remain elevated. As the housing market continues to cool, shelter costs will likely follow, leading to a further moderation in core prices. When combined with our view that the consumer will eventually rein in their spending, the stage will be set for the Fed to deliver a modest 75 basis points of rate cuts beginning in March of next year.

More weakness in Canadian international trade and manufacturing

In Canada, this week’s data highlighted the challenges facing the economy. First up was the international trade report for the month of October. At first glance, while a $200 million fall in the trade surplus is not an ideal outcome, it was expected given the fall in energy prices and slower growth in the U.S. economy. Upon closer examination, however, the decline in October’s trade surplus was actually closer to $700 million after factoring in the upwards revision to September’s surplus. This development has two significant implications for the overall economy. First, with a shaky start to the final quarter of the year, the growth of exports is forecast to fall by 3.6% in Q4, contributing to the lacklustre 1.8% growth rate expected for real GDP (our complete quarterly economic forecast will be released early next week). Second, in isolation the upwards revision in September has the potential to push real GDP growth in the third quarter higher. However, trade does not exist in a vacuum and odds are that some of the other components of growth (likely consumption and inventory investment) may also be revised lower to reflect lower import growth – likely offsetting part of the impact of the trade revision.

The second significant release in Canada was October’s manufacturing shipments. The details here were not pretty either. While the sector managed to avoid duplicating the dramatic 3.2% drop observed in September, shipments slipped by a further 0.1% – marking the third consecutive month of declines. Although new and unfilled orders picked up a touch, signaling a slightly less pessimistic view of the future, they too are coming off of significant declines in recent months. Suffice to say, Canadian manufacturers will continue to face a tough road ahead before feeling the boost from an expected pick-up in the U.S. economy in the second half of 2007.

Canadian productivity puzzle

We also learned this week that labour productivity in Canada fell by an annualized 0.3% in the third quarter, which was a much weaker outcome than we had expected. This marks the second consecutive quarterly decline, reinforcing the gradual deceleration in productivity observed over the last year. The surprise lay in the reported 2.4% increase in hours worked which was entirely at odds with the 0.6% quarterly decline reported in the Labour Force Survey (LFS) (Recall that labour productivity is the ratio of output to hours worked). While there are some methodological differences between the two measures (i.e. for the purposes of calculating productivity only the business sector is included while the LFS is an economy-wide measure), the sheer magnitude of the difference is suspicious and its effect is not trivial. As we noted in our recent report “A Primer on Potential Output” (available at http://www.td.com/economics/special/dt1106_potential.pdf), the growth of labour productivity not only has implications for our standard of living, but also for the conduct of monetary policy. A lower level of labour productivity implies that Canada’s potential growth rate may also be lower. If so, less economic slack will build during the near-term sub-par performance in the economy with the implication that the Bank of Canada would be less likely to lower interest rates in the face of slowing economic growth. On the other hand, given that the productivity data has been the source of major revisions in the past, it will be interesting to see if the fall in Q3 productivity is one day revised away. Thanks to this article from R. Paul Chadwick TD Canada Trust.

This will surely have a more positive impact upon our Toronto and GTA real estate marketplace and should allow for a very healthy winter and spring market to come!

For more information please contact A. Mark Argentino

A. Mark Argentino Associate Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS 905-828-3434

FAX 905-828-2829

E-MAIL mark@mississauga4sale.com

Website: Mississauga4Sale.com

Monday, December 18, 2006

8 Questions Real Estate Sellers Commonly Ask

I received an email from a prospective seller. Since the questions that he asked are somewhat common, I thought it would be best to post my answers here in my blog to help you in the event that you may be thinking of selling and have similar questions.

- Can I have to sign a listing agreement with you for 60days? Yes, 60 days is fine with me as most of the time it takes less than 60 days to market and sell a home. For people like yourself that have already been put into difficult situations with a long listing, I like to list it for 61 or 62 days, just in case it is not processed on the same day it begins, this is important. You may know this, but 60 days is the minimum period TREB will accept an mls listing.

- What’s the average length of time the homes you’ve listed have been on the market? Average time on the market this year is 3 to 5 weeks. If a property is well priced, it will sell within 2 weeks of listing, otherwise a price adjustment is necessary on about week 3 and then it will sell within 2 weeks, this is the reality of our marketplace.

- How many homes have you listed over the past six months? I just counted and I have listed 23 properties this year (2006) and all have sold. I have become a listing specialist, meaning that I concentrate most of my efforts on marketing and promoting my listings, rather than working with buyers. I usually carry about 3 to 5 listings at any one time and focus on getting them all sold. In 19+ years in real estate, I can think of only two properties that have ever expired, all my listings sell.

- How many of the homes you’ve listed over the past six months have sold? see above, I have one condo and one townhouse listed right now and two rental properties.

- How will you market my home? I will market and promote your home using the methods outlined on this page: http://www.mississauga4sale.com/marketing-16-point-plan-realtor.htm The key advantage that you will have with me is the fact that my website is currently #1 in the google directory for our area, which means that we will receive the highest amount of internet traffic and the most inquires and potential purchasers for your property, this is the truth. See this link on google

- How are you paid? I am paid through you, as is the listing broker.Read more about commissions

- Can you provide me with references? Yes I can. I provided him with 5 references, which of course I can give you too. I cannot post on the internet, as you can understand, privacy issues, besides the spam they would receive!

- Will you be going away on vacation in the next two months? No, I take vacation in the summer with my wife and two boys.

I have many clients similar to yourself that are out of town or absent from the property and all of our transactions are very successful. As long as my seller has email and uses it often, as you seem to prefer, then we will have a great business relationship. I use email all the time and prefer that means as our main method of communicating. I will email you the mls listing and the offer on your property and the counter offers etc. I scan all documents and use pdf format, this way you can print them out at your convenience and review and send back. As well, there is almost no loss in clarity, makes the lawyers very happy too.

You will receive regular updates from me on our progress. I have electronic records of all the showings and would be more than happy to forward to you once per week or whenever you want them. As well, I follow up and solicit feedback from all the agents that show your house and will attempt to help them with any questions or concerns they may have. Since the property is vacant, I will attempt, with your permission, to have a public open house every weekend until it's sold. This method allows for much higher traffic than most.

I will take many interior and exterior photos and create a very professional write-up on your property pointing out all the features and benefits of your home, with map etc. and once a buyer has read through all the information and photos and then contacts me, it's quite often that they buy the property. Here is an example of an online feature sheet.

You can be confident that I will be honest with you and do my best to get you the best price and terms for your property. I am highly motivated to get you sold too, we have the same goal.

The real estate market continues to be very active and homes have been selling well (see average price graph) over the past few months months. Near historic lows for mortgage interest rates have helped.

The winter real estate market is nearly upon us and sales continue to be brisk. We anticipate the real estate market will continue to be strong over the next month or two, especially if interest rates stay low. We are all hoping the market will sustain the momentum over the next few months and throughout the winter market.

Just in case, here are some items to read over and think about before you sell,

- 79 ideas and suggestions to get you more money when you sell

- The selling process explained in detail (a good refresher)

- Pricing your home to sell - tips and ideas to help you

- 8 seller mistakes and how to avoid them

- 16 point Marketing Plan to get your home SOLD

- Written Guarantees when you sell your home with Mark

- Example of online feature sheet that I will prepare for your home

As I mentioned at my website, my job is to give you all the information so you can make the best decision for yourself and your family. I look forward to helping you sell your home. I will work very hard to earn the right to be your trusted advisor, skilled negotiator and use my expert marketing and promotion to get your home sold at the best price and terms for you.

Thank you again for contacting me. Once you have analyzed and evaluated the above information please let me know how you would like to proceed.

Mark

So there you have it, answers to relevant seller questions.

For more information please contact A. Mark Argentino

A. Mark Argentino Associate Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS 905-828-3434

FAX 905-828-2829

E-MAIL mark@mississauga4sale.com

Website: Mississauga4Sale.com

Wednesday, December 06, 2006

December Toronto Real Estate Market Report - November 2006 breaks 6,000 Sales

The December Real Estate Market Report shows that November was still a good month and there were over 6,000 Sales

Signs of a healthy market are still around in the Toronto and GTA marketplace. The article below summarizes the recent press release from the Toronto Real Estate Board.

See a Graph of Price Trends

December 6, 2006 -- November put in another solid performance, with 6,281 sales transacted through the TorontoMLS system, Toronto Real Estate Board (TREB) President Dorothy Mason announced today. "This 6,000 plus figure is in keeping with a generally healthy real estate market," said the President.

"By the end of December, the Toronto area market will have exceeded 80,000 resales for only the third time in TREB history." Prices remained stable in November, with the average moderating slightly to $355,727 from October's $356,423.

The average was up four per cent over the November 2005 figure of $341,177.

This was the news release that was issued by the Toronto Real Estate Board.

Read the full report and see graphs of price trends

For more information please contact A. Mark Argentino

A. Mark Argentino Associate Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS 905-828-3434

FAX 905-828-2829

E-MAIL mark@mississauga4sale.com

Website: Mississauga4Sale.com