This is the latest report on the mls data for sales and activity for the

month of October across the country. It shows very interesting trends and

national averages.

Enjoy!

Mark

October a record breaking month for MLS(r) resale housing market

New records for the month were reported in about one-fifth of local markets

OTTAWA - November 16th, 2009 - According to The Canadian Real Estate

Association, sales activity reached the highest level ever for the month of

October.

Residential sales activity via the Multiple Listing Service(r) (MLS(r)) of

Canadian real estate boards numbered 42,288 units. This is up 41.5 per cent

compared to October 2008, when news of the global financial crisis hammered

consumer confidence. New records for the month were reported in about

one-fifth of local markets, including Toronto, Montreal, and Ottawa.

Seasonally adjusted national MLS(r) home sales totaled 45,818 units in

October 2009. This is two per cent higher than the previous record set in

May 2007, and 74 per cent above the recent low in January, when activity

fell to the lowest level in a decade. New monthly records for activity were

set in British Columbia, Ontario, and Quebec, which reflect record level

activity in Greater Vancouver, Toronto, Ottawa, Montreal and Quebec City.

Since the beginning of 2009, some 401,124 homes have traded hands via the

MLS(r) System. This is 1.6 per cent above the same period last year, but

below levels for this period in each of the previous three years.

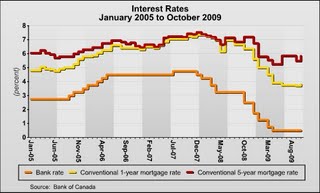

"Low interest rates and upbeat consumer confidence continue to release the

pent-up demand that built late last year and earlier this year," said CREA

President Dale Ripplinger. "The release of that pent-up demand has boosted

national sales activity to new heights and is drawing down inventories."

The national MLS(r) residential average price also reached new heights in

October 2009. At $341,079, the average sale price was up 20.7 per cent from

the same month last year. The increase reflects the high degree to which the

national average price was skewed downward last year by a significant

decline in activity in Canada's priciest markets, and then upward by the

rebound in activity.

The price trend is similar but less dramatic for the national MLS(r)

weighted average price, which compensates for changes in provincial sales

activity by taking into account provincial proportions of privately owned

housing stock. It set a record in October, rising 14 per cent on a

year-over-year basis.

October also saw the MLS(r) residential average price in Canada's major

markets improve. At $373,095, the average sale price was up 22.1 per cent

from the same month last year. As with the national counterpart, the price

trend is similar but less dramatic for the major market MLS(r) weighted

average price which rose in October 12 per cent on a year-over-year basis.

Seasonally adjusted new listings coming onto the MLS(r) Systems of real

estate boards across Canada inched up on a month-over-month basis in October

to 65,148 units. New listings peaked in May 2008 and declined sharply until

March 2009. Since April 2009, new listings have held to within a range of

66,500 units, plus or minus 1800 units.

The sharp rise in resale housing demand has increasingly shrunk inventories.

There were 194,994 homes listed for sale on the MLS(r) Systems of real

estate boards in Canada at the end of October 2009. This is 20.8 per cent

below the peak reached one year ago, and the sixth month in a row in which

inventories are down from year-ago levels.

Nationally, there were 4.1 months of inventory in October 2009 on a

seasonally adjusted basis, the lowest level in more than two years. The

actual (not seasonally adjusted) number of months of inventory in October

2009 stood at 4.6 months, which is down slightly from the previous month

(4.9 months), and among the lowest of levels this year. The number of months

of inventory is the number of months it would take to sell current

inventories at the current rate of sales activity.

"New listings are still expected to rise in the coming months in response to

headline average price increases," said CREA Chief Economist Gregory Klump.

"New supply dropped dramatically in December last year and earlier this year

in response to a difficult pricing environment. Sellers who moved to the

sidelines should be drawn back to the market as prices rise further over the

rest of the year and in early 2010."

PLEASE NOTE: The information contained in this news release combines both

major market and

national MLS(r) sales information from the previous month. The Canadian Real

Estate Association has previously released these separately.

CREA cautions that average price information can be useful in establishing

trends over time, but does not indicate actual prices in centres comprised

of widely divergent neighborhoods or account for price differential between

geographic areas. Statistical information contained in this report includes

all housing types.

MLS(r) is a co-operative marketing system used only by Canada's real estate

Boards to ensure maximum exposure of properties listed for sale.

The Canadian Real Estate Association (CREA) is one of Canada's largest

single-industry trade associations, representing more than 96,000

REALTORS(r) working through more than 100 real estate Boards and

Associations. Further information can be found at www.crea.ca.

I hope this finds you Happy and Healthy!

All the Best!

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

<http://www.mississauga4sale.com/selling-process.htm> Thinking of Selling?

Best Mortgage Rates

<http://www.mississauga4sale.com/mortgage-rates-mark.htm> Current Home

<http://www.mississauga4sale.com/TREBprice.htm> Prices Search MLS

<http://www.mississauga4sale.com/mls-ca-real-estate-mississauga.htm>

Newsletter

<http://www.mississauga4sale.com/newsletter/latest_newsletter.htm>

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

* BUS 905-828-3434

* FAX 905-828-2829 *CELL 416-520-1577

* E-MAIL <mailto:mark@mississauga4sale.com?subject=Mississauga Real Estate

Information Request> : mark@mississauga4sale.com

<mailto:mark@mississauga4sale.com?subject=Mississauga Real Estate

Information Request>

Website <http://www.mississauga4sale.com/index.htm> :

<http://www.mississauga4sale.com/index.htm> Mississauga4Sale.com

* Thinking of selling your home in the next 3 to 6 months? Would you

like a Complimentary

<http://www.mississauga4sale.com/internet-evaluation.htm> & Quick

Over-The-Net Home Evaluation ?

* Power of Sales and Foreclosures

<http://www.mississauga4sale.com/Power-Sales-Bank-Sales-Alert-Request.htm>

* If you have not already signed up to receive my monthly real estate

newsletter, you may do so here: On-Line

<http://www.mississauga4sale.com/popupquestion.htm> Real Estate Newsletter

sign up

* See seasonal housing patterns

<http://www.mississauga4sale.com/TREBavg1995date.htm>

* Would you like me to send you a 2009 Calendar

<http://www.mississauga4sale.com/Calendar-Order-Form.htm> ?