Thursday, February 04, 2010

How to find Tax Sale Properties in your Municipality

Wednesday, February 03, 2010

Why does maintenance fee show $0 for many power of sale properties?

Thanks for your daily information and sure helps...I have a question for you some of the listing says $0 maintenance fees what does that really mean? Is it that the POS includes the maintenance fees for one year?

Thank you for your real estate inquiry.

The maintenance fee shows $0 because the bank does not want to take any responsibility for any oversight or underestimate of the fee, so they put $0.We/You have to find out from us what the average is for that type of unit.

When you submit your offer, we will receive a status certificate that shows the exact fee for that particular unit.

Mark

Monday, February 01, 2010

$1500 extra taxes due to HST in real estate transactions in Toronto and Mississauga

The HST effectively combines the 8% Provincial Sales Tax (PST) and the 5%

Federal Goods and Services Tax (GST) for a combined 13% sales tax rate known

as the Harmonized Sales Tax (HST).

The HST will apply to a number of goods and services that are currently

exempt.

For housing in Ontario, the HST will add 8% more tax on any services related

to real estate transactions, such as real estate commissions, legal fees,

home inspections and moving costs.

It is estimated by OREA that the HST will add about $1500 in additional

taxes to the cost of the average residential real estate transaction.

It is expected that there will be a surge in sales this spring to avoid the

HST that becomes law on July 1st.

All the best!

Mark

Friday, January 29, 2010

Power-of-sale, Foreclosure, Foreclosures and quit claim question

thought I would share the information with you

Enjoy!

Mark

Mark,

You have one of the best site for general information and quality for make a

house sold.

My name is A .G., I am the mortgage holder of this house that we sold in T .

Ontario about three years go'.

The people in the house have develop financial problems. They start running

too many charges where now start default in not making the payments.

My question is: should I execute Power of sale or in return to have the

house with list damage I should accept the quit claim. Read about Power of

Sale and quit claim on my site here:

http://www.mississauga4sale.com/Power-Sales-Bank-Sales-Alert-Request.htm

They have zero equity in this house. They only put down $5000 on house price

of 220,000. The command price in the house is less now then when was sold.

I wish you were here and I would hire on the spot. Your luggage of

information is outstanding

Thanks,

A.

Thursday, January 28, 2010

step by step outline on how to become a real estate broker in Ontario

As a fellow engineer, I'm hoping you could provide me with a step by step

outline on how to become a real estate broker in Ontario. I would like to

start part time until I have enough experience to write the brokers exam.

Any assistance is appreciated.

Thank you.

Jim

My answer:

Hi Jim,

Thank you for your email. Licensing in Ontario is governed by the Ontario

Real Estate Organization.

I have a section just for people like you with questions about how to obtain

their real estate license:

http://www.mississauga4sale.com/how-to-become-a-real-estate-agent-realtor.ht

m

Their website has a step by step outline,

I wish you all the best!

Mark

Wednesday, January 27, 2010

Should I lock in at 5 year or variable mortgage interest rate?

Hi Mark,

After looking through a whole bunch of Google results, I found yours the

most intelligent and sensible. So, if you don't mind, I would like to ask

you this at this point in time, as your posting is somewhat old:

I am being offered these two options before my March 2 renewal date on a

$202,000 mortgage with 23 yr. amortization:

1). 5 Year Closed @ 3.81% - 23 Year Amortization with Weekly Regular

Payments: $252.77

2). 5 Year Variable @ Prime Minus 0.35% (currently 1.90%) - 23 Year

Amortization with Weekly Regular Payments: $208.32

Which one would YOU choose?

Thanks.

--

H.S.A. Harry, Calgary, Alberta, Canada

Hi H .,

I am a firm believer in paying that mortgage off. We may never see today's'

rates again. I would go with option 2 and have your bank lower your

amortization on renewal until the payment is $250 per week. This should

reduce your amortization to about 18.2 years, see the calculator here:

http://www.mississauga4sale.com/mortgage-amortization-creator.htm

Then in 5 years when it comes time to renew, you will only have 13 years

left to go on your mortgage.

Even if the prime rate increases, which it is supposed to, the 5 year

variable has to climb to about 5.5% for you to be even compared to the 3.81%

mortgage for 5 years and you will still be ahead of the game. Reason is, it

may take 2 years to reach 5.5%, if ever, and then you have saved a pile in

interest in the first 2 years of your mortgage. You should be earning more

in 2 years from now and look at it as an investment in yourself.

Also, in 3 years, you can renew that 5 year mortgage and who knows, there

may be some good specials out there that you can take advantage of.

You should be better off in the long run going short term, read my

experience here:

http://www.mississauga4sale.com/Lock-In-Short-Term-Long-Term-Mortgage.htm

All the best!

Mark

Tuesday, January 26, 2010

Current Mortgage Interest rates

Please browse and

http://www.mississauga4sale.com/Rates-Current-Posted-Mortage-Interest-Rate.htmview the current mortgage interest rates and how they have changed over

the past few months.

You can view and compare Today's Low Canada and Ontario Current Mortgage

Interest rates from major lenders for discounted, variable, fixed and prime

rates in Canada and a mortgage calculator at this page:

http://www.mississauga4sale.com/Rates-Current-Posted-Mortage-Interest-Rate.htm

Any time you have questions about interest rates, please let me know. As an

experienced RE/MAX(r) agent who has helped many people purchase homes, I

have every confidence that I'll be able to help you find what you're looking

for as long as we work together and keep in frequent contact.

I look forward to our next meeting. Please feel free to call or email me.

You may sign up to my monthly real estate newsletter using this link:

http://www.mississauga4sale.com/popupquestion.htm; On-Line Real Estate

Newsletter sign up

Or you may wish to receive new

http://www.mississauga4sale.com/Power-Sales-Bank-Sales-Alert-Request.htm

Power of Sale Listings twice per week.

Please let me know if you have any other questions or if there is anything

else I can help you with.

Thank you again for contacting me and I will do my best to help you with

your real estate needs,

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

Monday, January 25, 2010

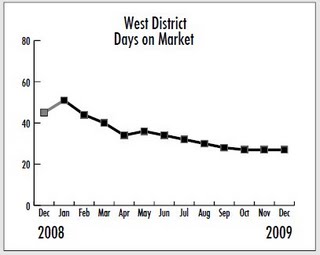

Number of days on market in west zones for Toronto Mississauga and GTA Real Estate Marketplace

For more information please contact A. Mark Argentino

A. Mark Argentino, Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc., Brokerage

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS. 905-828-3434

FAX. 905-828-2829

E-MAIL: mark@mississauga4sale.com

Website: Mississauga4Sale.com

Friday, January 22, 2010

Could this be the home?

this link

If you'd like to view this home or any other home on the page please email

or call me anytime.

Maybe you are interested in POS (Power of Sale) listings, if so,

http://www.mississauga4sale.com/Power-Sales-Bank-Sales-Alert-Request.htm

follow this link

Hope to hear from you soon!

Thanks again.

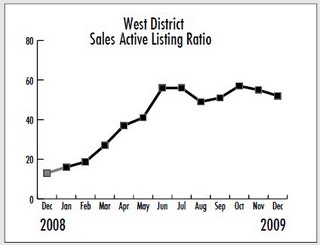

Ratio of Sales to active listings in west Toronto Mississauga and GTA Real Estate Marketplace

This indicates that about 55% or so of homes on the market are selling, this is very high compared to historical data that shows about 40 to 45% of active listings sell. Again, another indicator that our housing market is quite hot in the west GTA

For more information please contact A. Mark Argentino

A. Mark Argentino, Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc., Brokerage

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS. 905-828-3434

FAX. 905-828-2829

E-MAIL: mark@mississauga4sale.com

Website: Mississauga4Sale.com