Bank of Canada raises its key interest rate by half a percentage point to 1% on WEDNESDAY, APRIL 13, 2022

Bank Prime lending rates are now 3.2%

It's the first half-point hike in more than two decades amid soaring inflation.

This is a great article about the

future of real estate in the GTA and how interest rates may be one of the factors that affect the real estate marketplace, or read below:

Toronto Real Estate forecast 2022, April 11, 2022

Wednesday, April 13⋅7:00 – 8:00am

Toronto real estate forecast 2022

by Corben Grant on 11 Apr 2022

After a hectic two years, in both real estate and the world at large, we have made it 2022 and it seems we are now entering yet another new phase. Though the world is slowly returning to normal, those paying attention to the real estate market are left wondering – what exactly does “normal” look like? How will things play out following the unprecedented market conditions of the last two years?

In Toronto, one of Canada's largest real estate markets, thousands of investors are now trying to anticipate what the future will hold and others are wondering if now is the time to buy in.

Telling the future is understandably a difficult and ultimately futile practice. However, there are many informed analysts who can at least give a pretty good guess. By looking at past market conditions, upcoming economic and legislative changes, and a bit of guesswork, it’s possible to make a more informed forecast.

In this article, we will explore what the 2022 Toronto real estate market could look like.

Current statistics

Before we get into the future of the market, we should probably understand how it stands now. All data in the following section is sourced from the Toronto Regional Real Estate Board's (TRREB) most recent market statistics from March 2022.

In March of 2022, the Toronto real estate market continued at an active pace though in some key areas it showed some signs of balancing. Overall, it was marked as the third-best March on record and the second-best first quarter on record.

Housing prices down from February 2022

The average overall price across the GTA and for all housing types was $1,299,894. This marks one of the first decreases in price seen in quite a while, down from $1,334,544 in February. This also goes against the seasonal trend that would tend to see prices begin to rise into the spring market. Despite the month-over-month dip, price growth still remained in the double digits on a year-over-year basis, up from $1,097,351 in March of 2021.

Detached homes sold at an average price of $1,920,018 and $1,632,832 in Toronto and the GTA respectively, both down from the previous month for a combined average of $1,697,396. Prices weren't down across the board, however, as the condo market notably saw marginal price gains from last month.

Both listings and sales were lower than the high records of March 2021, though they were up from the previous month. Supply on the market remained at around just one month.

An anomaly or a sign of things to come?

This last month then presented a moderately more balanced market for Toronto, though we are far from out of the woods yet. What remains to be seen is if this is a temporary off month or the start of a longer trend in the market.

TRREB Chief Market Analyst Jason Mercer is quoted in the release as saying that though competition among buyers remains strong in most segments, the city did “experience more balance in the first quarter of 2022 compared to last year. If this trend continues, it is possible that the pace of price growth could moderate as we move through the year.”

What 2022 will hold for the Toronto housing market

There are years where housing markets are fairly easy to predict with some accuracy as was the case for some of the pre-pandemic years in Toronto. However, the last two years have proven that unexpected events are very real and major disruptions can happen out of nowhere.

2022 is looking to be another year of unpredictable changes in the market. With the world recovering gradually from a global pandemic, the reinvigoration of the Canadian economy, rising interest rates, and new legislation coming into effect to cool the real estate market, there will be no shortage of potential shake-ups this year.

Each of these new factors will naturally have its own effects, but the combined effect of all the changes together becomes increasingly difficult to call. In the next section, we will look at some of the new changes expected for this year and how they can affect the housing market.

Rising interest rates

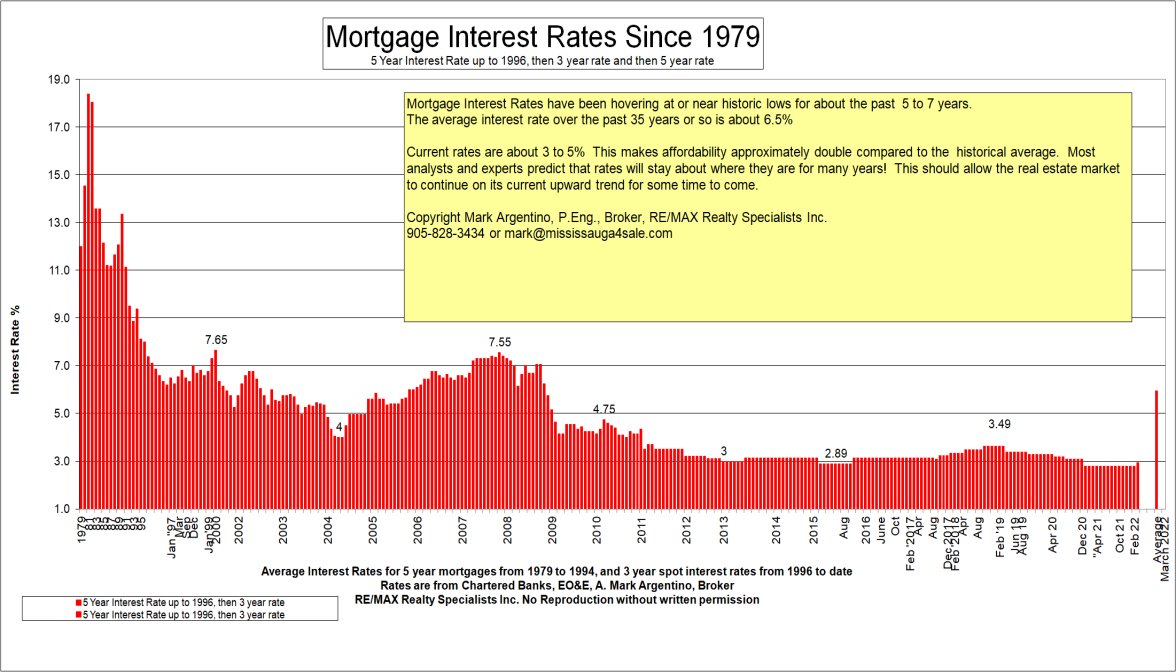

One of the biggest changes that are essentially guaranteed to play a role in the market this year is the interest rate increase from the bank of Canada.

Many reaped the benefits of record low rates in 2020-2021

During the depths of the pandemic, the Bank of Canada kept its prime interest rate at a record low level in order to aid the economy in getting through difficult times. While it may have helped the economy, the low-interest rates also played a part in driving up prices in Canada's real estate market, as well as growing inflation. With such low interest rates, buyers were able to afford higher mortgages so prices began to grow.

Multiple interest rate hikes predicted for this year

Now, the central bank has begun to raise interest rates, with a first hike occurring in March and at least a few more predicted for the rest of the year. The impact of gradually increasing rates on the Canadian housing market won't be instantaneous, but we should see effects sooner than later. As interest rates rise, more potential buyers will fail to qualify for loans, lowering the demand on the market. Those who do qualify will need to look for lower-priced homes. The hope is that this will cool the market somewhat.

New legislation in the Toronto real estate market

Housing concerns have been on the top of the agenda across nearly all party lines in Canadian politics for the last number of years and new legislation on both the provincial and federal levels are set to be put in place this year to curb the rampant housing market.

Non-Resident Speculation Tax

Recently, the province announced an increase to the Non-Resident Speculation Tax and a widening of its applicable area. The result is that any foreigners looking to buy homes in Toronto will be forced to pay a tax of 20%. This should reduce some demand on the market and allow Canadian residents a chance to buy homes with less competition.

Foreign Homebuyers Ban

On the federal level, the liberal government is set to take an even stricter stance, with a proposal to ban almost all foreign purchases for up to two years. This would all but erase completion from foreign buyers and reduce a lot of competition for homes. The matter of foreign buyers is contentious as there is still plenty of domestic demand for homes that will keep prices elevated, however, reduced competition is nonetheless welcome.

New housing supply initiatives

The Ontario government is also moving forward with plans to increase housing supply in coming years by streamlining development processes, with hopes to build 1.5 million new homes in the next 10 years. This should serve to combat the low housing supply that has plagued the market in recent years.

Toronto Vacant Homes Tax

Finally, Toronto itself has a newly instated Vacant Homes Tax coming into effect that hopes to bring more houses to the market. Such a tax has been effective in Vancouver to reduce the overall number of vacant homes, relieving some pressure on both the resale and rental markets.

In combination, these new laws should reduce demand and competition, while increasing the housing supply. While it is unlikely to cause a significant drop in house prices, it will allow for the market to cool and balance and help to ease the incredibly strong seller's market seen in recent years.

Economic recovery

Another aspect that can come into play for the housing market is an overall move towards a stronger Canadian economy in the recovery from the pandemic recession. As supply chain conditions begin to improve, this can have positive effects on the price of new-home development. Reigning inflation will also help ease financial burdens on Canadians and growing rates of employment and income will allow more Canadians to enter the market.

Unexpected events

One thing that recent times have made abundantly clear is that you never know what is around the corner. Even our best predictions will fail nine times out of 10 times to foresee the most unexpected events.

The two biggest causes of uncertainty right now come from the continued presence of COVID

15 minutes before

Mark Argentino

For more information please contact A. Mark Argentino

A. Mark Argentino, Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc., Brokerage

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS. 905-828-3434

FAX. 905-828-2829

E-MAIL:

mark@mississauga4sale.com

Website:

Mississauga4Sale.com