Condominium sales post double-digit gains in Q1 2006 in most major Canadian centres, says RE/MAX

06:30 EDT Thursday, May 11, 2006

"For some first-time buyers, condominiums represent the only means of homeownership."

MISSISSAUGA, ON, May 11 /CNW/ - Unprecedented demand for condominium apartments and town homes has sparked double-digit gains in unit sales in most major Canadian centres during the first quarter of 2006, according to a report released today by RE/MAX.

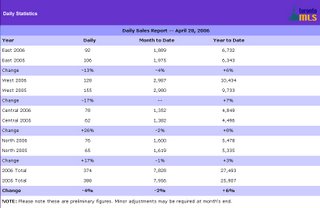

The RE/MAX Condominium Report found that both sales and prices were climbing in the eight markets examined, including Halifax, Ottawa, Toronto, Calgary, Edmonton, Kelowna, Victoria, and Vancouver. The highest percentage increases were found in Alberta, with sales in both Calgary and Edmonton ahead of 2005 first quarter figures by approximately 40 per cent. The number of condominiums sold in Victoria, Kelowna, and Toronto were up in excess of 10 per cent, while more moderate gains of five, four and three per cent were reported in Vancouver, Ottawa, and Halifax respectively.

"Rapid price appreciation has had a definite impact on condominium sales across the country," says Michael Polzler, Executive Vice President and Regional Director, RE/MAX Ontario-Atlantic Canada. "As the cost of more conventional housing rises, condominiums represent the only means of home ownership for some first-time buyers."

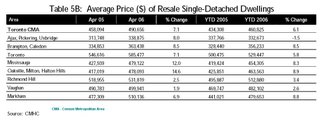

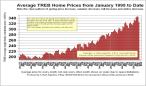

Western markets, in particular, are reporting strong upward pressure on overall residential average price (includes all single-family dwellings, including condominiums). To illustrate, housing values in Calgary rose a substantial 26 per cent to just over $308,000 year-to-date while average price in Vancouver jumped 22 per cent over the 2005 level to more than $482,000. Although Toronto experienced a more modest increase of approximately six per cent over Q1 2005, hot pocket areas are seeing even greater appreciation.

"Affordability has become a serious issue across the country," says Elton Ash, Regional Executive Vice President, RE/MAX of Western Canada. "Despite relatively low interest rates and the availability of longer amortization periods, many first-time buyers are finding they have to stretch their budgets to realize the dream of home ownership. Condominiums are the easy answer for most because they offer the best of both worlds -- affordability and location."

Entry-level purchasers and move-up buyers, typically aging baby boomers, are most active in the condominium market. The most popular price point is $150,000 - $250,000, although in markets like Vancouver and Toronto, the strongest segments are closer to $300,000 - $400,000. Luxury sales are brisk from coast to coast, with almost all markets surveyed reporting an upswing in sales over $500,000. In Toronto, sales of condominiums priced in excess of $500,000 have risen 68 per cent to 170 units year-to-date, compared to 101 units during the same period in 2005.

"For many years, young professionals under the age of 40 dominated Toronto's condominium market," says Polzler. "The pendulum is now starting to shift, with baby boomers between 50 to 60 years of age emerging as a force in the marketplace. The condominium lifestyle is the major attraction for most mature buyers."

In Vancouver, more and more upscale developments are coming on-stream, especially in the Coal Harbour and the Beach Crescent neighbourhoods.

"With Canada's economic engine firing on all cylinders, and no dark clouds on the horizon, it's relatively safe to say that 2006 will be a banner year for condominium sales across the board," says Ash. "This is particularly true in the West, where condominiums are becoming an increasingly attractive alternative to single-detached housing."

Highlights:

- Inventory levels were an issue in many markets examined, resulting in

upward pressure on condominium values.

- Multiple offers were commonplace in three markets during the first

quarter of 2006 - Vancouver, Calgary, and Toronto.

- Condominiums accounted for close to 50 per cent of total residential

sales in the Greater Area Vancouver between January - March 31, 2006.

RE/MAX is Canada's leading real estate organization with over 16,150 sales associates situated throughout its more than 620 independently owned and operated offices across the country. The RE/MAX franchise network, now in its 33rd year of consecutive growth, is a global real estate system operating in over 63 countries. More than 6,320 independently owned offices engage 117,595 member sales associates who lead the industry in professional designations, experience and production while providing real estate services in residential, commercial, referral, relocation and asset management. For more information, visit: www.remax.ca

To view the report, please visit:

http://files.newswire.ca/40/REMAXReport.pdf

See more condos information in Mississauga