This is what the regional director of RE/MAX Ontario Atlantic is telling us about the state of the economy, the real estate market and what we are reading in the press these days. He is saying that what is reported in the press is doom and gloom and if you ignore most of it, you will do fine. I agree, what do you think?MarkIf the cup of coffee you were drinking on Tuesday morning didn't wake you up, the headline on the front page of the Globe and Mail most surely did.

The headlines screamed "Housing sales hit 20-year low as real estate slump widens" followed by huge sub-head noting an 11 per cent decline in prices and a 44 per cent drop in Ontario housing sales in large RED print, based on the December 15th press release issued by the Canadian Real Estate Association.

The only problem with the article is that it is incorrect. In the third paragraph, the author writes "Between May and November, the average price of an existing home in Canada fell by 11 per cent, matching the drop in 1990 that coincided with the onset of a painful recession. Housing prices would go on to fall about 20 per cent and it would be another decade before they managed to make new highs."

Unfortunately for the Globe, there was no 20 per cent drop. According to the Canadian Real Estate Association, the Canadian average price actually rose approximately 15 per cent from 1990 to 2000. There were three moderate dips in housing values in the decade – 1990 (3.4 per cent), 1995 (4.6 per cent), and 1998 (1.5 per cent). Average price in Canada has climbed consistently since 1998. It's also important to note that the decline in national housing values have typically been modest and have bounced back almost immediately. Finally there are no two consecutive years of falling prices.

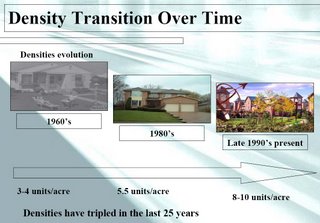

While the national housing picture has been a picture of stability, average housing values in Ontario have seen slightly more volatility over the past 27 years. There have been six decreases in average price noted – with five of the six occurring between 1990 and 1996. Prices fell 17 per cent during that time frame, after climbing a phenomenal 70 per cent between 1986 to 1989 ($107,158 to $182,186). Residential average price has been on an upward trajectory since 1996 – the longest uninterrupted period of growth since 1980.

Based on our comments, the Globe and Mail has printed a correction in this morning's newspaper, page A2

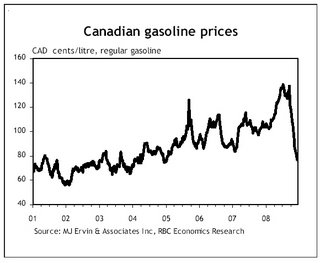

So now that the folks at the Globe have been straightened out, we shift our focus to the challenges today's economic realities are bringing to the housing market. Truth be told, there is not a sector - not even gold - that has not been hard hit by economic turmoil in recent months. Real estate has held up remarkably well, in light of current market realities. We need to see some economic stability - and a recovery in consumer confidence levels - before we can expect housing markets to rebound. Job security will be key.

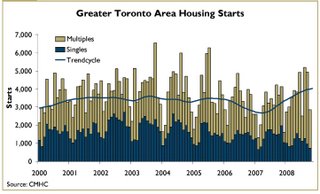

Inventory will also play an important role. If inventory levels subside, we could see stability return to housing values. To illustrate, new listings fell seven per cent in the Greater Toronto Area in November. If this trend continues, and existing inventory is absorbed, housing values may remain relatively stable in the year ahead.

I'd like to conclude today's communication with the story of a hot dog vendor in Chicago who sold the very best hot dogs by the side of the road. His business was booming, people loved his hot dogs, and his business steadily increases month after month. The man loved his business and believed in the need to provide great food at a great price.

This man was so busy advertising and selling his hot dogs and making lots of money, that he didn't even have time to read the newspaper or listen to the radio. Consequently, he never heard a word about a predicted recession or the need to cut back to save for the potential economic slowdown. As long as he continued to offer his delicious hot dogs, his customers bought them. He kept selling, and they kept buying.

Then one day his college educated son told him that an economic recession was surely coming. His son told him that people wouldn't have enough money to buy his hot dogs. The successful hot dog vendor believed this, so on his son's advice, he cut back on his advertising. Additionally, he started ordering less supplies and product, because after all, people would be cutting back soon.

He even went so far as to take down many of the billboards that lead to his roadside stand. And sure enough, people stopped coming to him. People stopped buying his hot dogs, and he eventually went broke.

Then he thought to himself. "How smart my son is in predicting this."

Don't be influenced by what you read in the newspapers or hear on your television. It's true that market conditions have changed, but human nature has not. Real estate is one of the largest investments people will make in their lifetime. It's also one of the safest. Get out and spread the word. If you bought a home in 1980 worth $67,000, that property is valued at over $300,000 today – an increase of 350 per cent and the profit is capital gains exempt. It's no wonder that Canada has one of the highest homeownership rates in the world, at close to 70 per cent.

No matter what the investment community will tell you, you can't live in your mutual fund.

I hope this finds you happy and healthy,

Mark