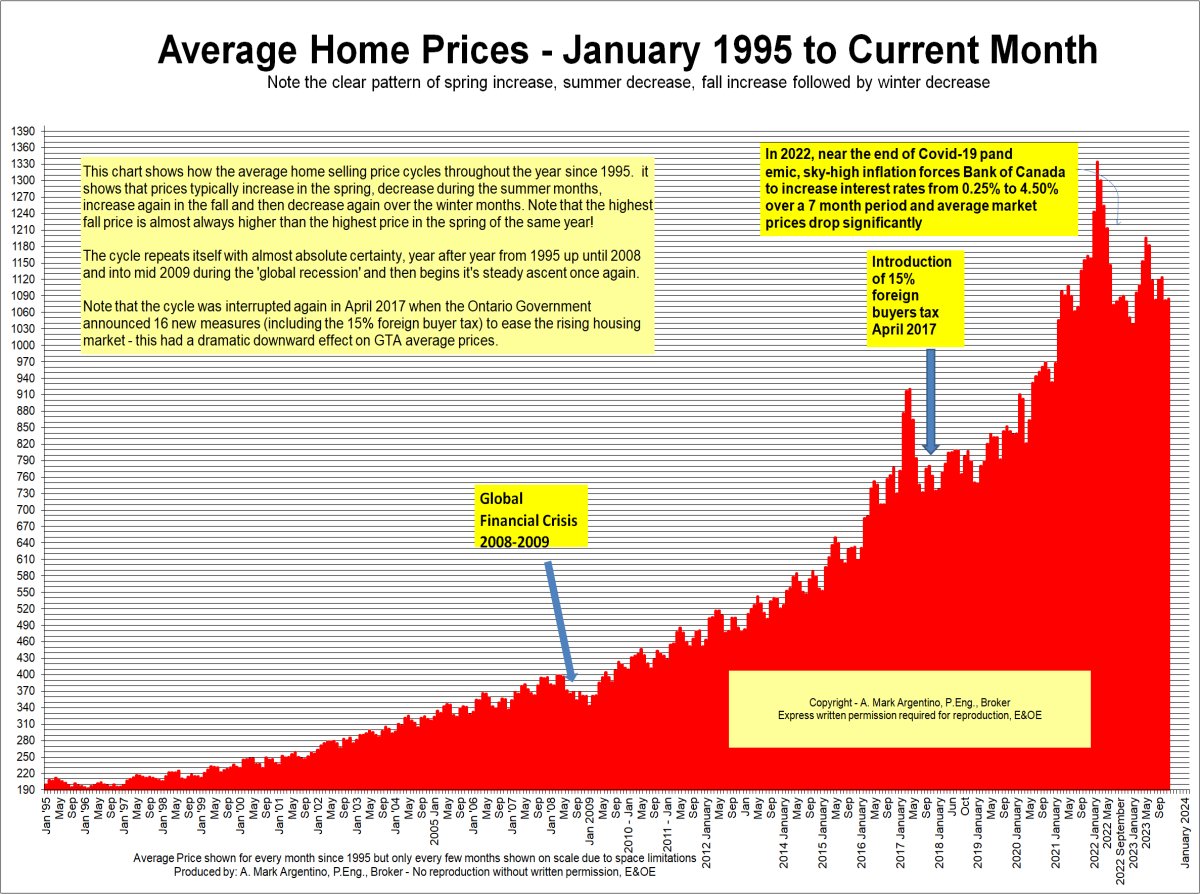

It's not all doom and gloom, but it shows how quickly the market can turn. We've seen this before in 1988/1989 and again in 2008/2009 - this could be a short blip in the market or a trend, only time will tell!

Friday, August 25, 2017

Sales Bubble? Average GTA Prices and Sales volumes can seem confusing - I'll try and remove some of the confusion

It's not all doom and gloom, but it shows how quickly the market can turn. We've seen this before in 1988/1989 and again in 2008/2009 - this could be a short blip in the market or a trend, only time will tell!

Monday, June 05, 2017

Mississauga and GTA Real Estate Marketplace Conditions as reported on June 5th 2017

P. Eng. Broker

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

BUS 905-828-3434

FAX 905-828-2829 CELL 416-520-1577

mark@mississauga4sale.com

Mississauga4Sale.com

- Thinking of selling your home in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

http://www.mississauga4sale.com/internet-evaluation.htm - Power of Sales and Foreclosureshttp://www.mississauga4sale.com/Power-Sales-Bank-Sales-Alert-Request.htm

- If you have not already signed up to receive my monthly real estate newsletter, you may do so here: On-Line Real Estate Newsletter sign up

http://www.mississauga4sale.com/popupquestion.htm - See seasonal housing patterns http://www.mississauga4sale.com/TREBprice.htm

Wednesday, April 06, 2016

Residential Real Estate Market in the GTA April 2016 Highlights of the latest report from TREB

- The Average price for last month was $688,181 (it was $685,278 the previous month) and this represents aver a 12.1% increase compared to the same month last year- see graph of prices here

- Sales volumes were 10,326 (it was 7,621 last month) and this an 15.8% increase from the same month last year

- The 2015 calendar year total number of sales was 101,299 – a substantial 9.2 per cent increase compared to 2014 as a whole

- There were 22,575 sales in the first quarter of 2016 and the year-over-year growth rate for sales was 15.8 per cent for Q1 2016.

- The Bank of Canada Prime Lending Rate now stands at 2.70% steady (since July 2015) read more

Strong Growth in Home Sales in March/Q1

P. Eng. Broker

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

BUS 905-828-3434

FAX 905-828-2829 CELL 416-520-1577

mark@mississauga4sale.com

Mississauga4Sale.com

- Thinking of selling your home in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

http://www.mississauga4sale.com/internet-evaluation.htm - Power of Sales and Foreclosureshttp://www.mississauga4sale.com/Power-Sales-Bank-Sales-Alert-Request.htm

- If you have not already signed up to receive my monthly real estate newsletter, you may do so here: On-Line Real Estate Newsletter sign up

http://www.mississauga4sale.com/popupquestion.htm - See seasonal housing patternshttp://www.mississauga4sale.com/TREBprice.htm

Friday, March 04, 2016

Highlights Latest Report from TREB Market Watch for the Residential Real Estate Market in the GTA March 2016

- The Average price for last month was $685,278 (it was $631,092 the previous month) and this represents aver a 11.1% increase compared to the same month last year

- see graph of prices here - Sales volumes were 7,621 (it was 4,672 last month) and this an 21.1% increase from the same month last year

- The Bank of Canada Prime Lending Rate now stands at 0.50% since July 2015 read more

read more - See more at this page about average prices and read the TREB full price and data report below.

This is the full price and data report from TREB for last month

P. Eng. Broker

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

BUS 905-828-3434

FAX 905-828-2829 CELL 416-520-1577

mark@mississauga4sale.com

Mississauga4Sale.com

- Thinking of selling your home in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

http://www.mississauga4sale.com/internet-evaluation.htm - Power of Sales and Foreclosureshttp://www.mississauga4sale.com/Power-Sales-Bank-Sales-Alert-Request.htm

- If you have not already signed up to receive my monthly real estate newsletter, you may do so here: On-Line Real Estate Newsletter sign up

http://www.mississauga4sale.com/popupquestion.htm - See seasonal housing patternshttp://www.mississauga4sale.com/TREBprice.htm

Friday, December 05, 2014

Toronto Real Estate Board latest sales results for single family dwellings in GTA

P. Eng. Broker

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

BUS 905-828-3434

FAX 905-828-2829 CELL 416-520-1577

mark@mississauga4sale.comMississauga4Sale.com

www.mississauga4sale.com/internet-evaluation.htm

www.mississauga4sale.com/Power-Sales-Bank-Sales-Alert-Request.htm

www.mississauga4sale.com/popupquestion.htm

www.mississauga4sale.com/TREBprice.htm

www.mississauga4sale.com/Calendar-Order-Form.htm

Thursday, January 12, 2012

Months of Inventory (MOI) Indicator Toronto Real Estate Board now calculating and publishing

TREB Publishing New Months of Inventory Indicator

January 9, 2012 -- Happy New Year! I hope all TREB Members had a restful holiday season after a very busy 2011. Just to recap, we had the second-best year on record in terms of sales (89,347) and the average selling price rose by eight per cent to $465,412. At the same time, total new listings for the year were down by almost four per cent.

The supply side of the market was the big story over the last 12 months. I am guessing that many TREB Members had clients who faced significant competition from other Buyers when trying to get a deal done on a home. On the flip side, I am guessing that many Members also had listings that attracted substantial interest and sold in short order for a good price.

What I am describing here is a typical Sellers' market: lots of Buyers, a shortage of listings and strong price growth.

TREB is now publishing a Months of Inventory (MOI) indicator to help Members and the public get a better handle on market conditions. MOI is also published at the national scale in Canada by CREA and in the United States by NAR. I want to briefly explain how this new indicator works and then give some examples of its use.

MOI is calculated by dividing the 12-month average for active listings by the 12-month average for sales. The result tells us how long it would have taken, on average, to sell all actively listed homes. As of the end of December, this number was 2.2 months. If, moving forward, we see the MOI trend upwards this would suggest that the market is becoming better supplied and we may see less upward pressure on price. If we see the indicator trend lower, this would suggest that market conditions are tightening and strong upward pressure will continue to be exerted on price.

In the post-recession period, MOI has hovered in the 2.0 to 2.5 month range.

This is substantially lower than the pre-recession norm of between 3.0 and 3.5 month range. When we look at market conditions in this context, it is easy to see why we have seen above average price growth over the last couple of years - eight per cent last year following nine per cent in 2010.

We can also use MOI to compare different municipalities in the GTA. A look at the MOI column on pages 3 and 4 of the December Market Watch shows us that the relationship between sales and listings varies quite a bit across the region - from a low of 1.2 months to a high of over nine months.

The MOI can also help us position the GTA within the national context.

According to CREA, MOI was 7.4 months for Canada and 4.8 months for Ontario in November versus 2.2 months for the GTA. This may suggest that the GTA market is tighter than the national and Ontario averages. With this in mind, it is not surprising that year-to-date average price growth for the GTA was in the upper third of Canadian metropolitan areas.

However, when making these types of comparisons it is important to bear in mind that each market area has evolved differently over time. So, while a more balanced market in Toronto may be associated with MOI of 3.5, other markets may be characterized by a MOI of six months.

As we move through 2012, we should expect to see the MOI start to increase.

The strong price growth we have seen over the last year should prompt more households to list. In fact, we have started to see year-over-year growth in new listings outstrip growth in sales in many parts of the GTA. If this trend continues, we will likely see the annual rate of price growth moderate into the mid-single-digits.

I hope this finds you Happy and Healthy!

All the Best!

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

BUS 905-828-3434

FAX 905-828-2829 CELL 416-520-1577

mark@mississauga4sale.com

Mississauga4Sale.com

* Thinking of selling your home in the next 3 to 6 months? Would you

like a Complimentary & Quick Over-The-Net Home Evaluation ?

www.mississauga4sale.com/internet-evaluation.htm

* Power of Sales and Foreclosures

www.mississauga4sale.com/Power-Sales-Bank-Sales-Alert-Request.htm

* If you have not already signed up to receive my monthly real estate

newsletter, you may do so here: On-Line Real Estate Newsletter sign up

www.mississauga4sale.com/popupquestion.htm

* See seasonal housing patterns

www.mississauga4sale.com/TREBprice.htm

* Would you like me to send you a desk or wall Calendar?

www.mississauga4sale.com/Calendar-Order-Form.htm