Tuesday, March 31, 2009

Confusion at Kingsbridge Gardens Circle Condos Mississauga

Sunday, March 29, 2009

Mortgage interest rate decrease

Mortgage rates are very low, and you can secure a 120 day rate hold by going through the preapproval process.

Current mortgage interest rates are below

Best rates as of March 2 3rd, 2009*

Prime................2.50%

Variable........... Prime plus .80%

1 yr closed........3.25%

2 yr closed........3.80%

3 yr closed........3.84%

4 yr closed........4.10%

5 yr closed....... 3.99%

7 yr closed........5.15%

10 yr closed......5.25%

*Rates subject to change without notice

I hope this finds you Happy and Healthy!

All the Best!

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

Thinking of Selling? Best Mortgage Rates Current Home Prices Search MLS Newsletter

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

( BUS 905-828-3434

2 FAX 905-828-2829 ÈCELL 416-520-1577

› E-MAIL : mark@mississauga4sale.com

Website : Mississauga4Sale.com

- Thinking of selling your home in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

- Power of Sales and Foreclosures

- If you have not already signed up to receive my monthly real estate newsletter, you may do so here: On-Line Real Estate Newsletter sign up

- See seasonal housing patterns

- Would you like me to send you a 2009 Calendar?

Saturday, March 28, 2009

Mortgage interest rate update

It’s a great time to lock in their rates for 120 days. (till July) or tell your family and friends!

If you have a closing within 30 days can take advantage of a low rate of 3.99%.(o.a.c). on a 5 year closed term.

5 YEAR TERMS

5 YEAR closed 4.05% (120 DAYS)

CLOSED VRM prime plus 0.80% (3.30%)

OPEN VRM prime plus 1.00% (3.50%)

I hope this finds you Happy and Healthy!

All the Best!

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

Thinking of Selling? Best Mortgage Rates Current Home Prices Search MLS Newsletter

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

( BUS 905-828-3434

2 FAX 905-828-2829 ÈCELL 416-520-1577

› E-MAIL : mailto:mark@mississauga4sale.com?subject=Mississauga

Website : Mississauga4Sale.com

- Thinking of selling your home in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

- Power of Sales and Foreclosures

- If you have not already signed up to receive my monthly real estate newsletter, you may do so here: On-Line Real Estate Newsletter sign up

- See seasonal housing patterns

- Would you like me to send you a 2009 Calendar?

Friday, March 27, 2009

Anyone can sell a Corvette at half price!

From: [mailto:]

Sent: Tuesday, March 10, 2009 3:07 PM

To: mark@mississauga4sale.com

Subject: Information Request

Hi Mark

I am impressed!

Just found your site when asking the question: What percentage of listing agents are selling agents?

As I wanted to see the stats on agents listing, do they sell your house, or do agents from other companies actually sell your house?

Even though we wont be using your services as we are in BC and you are in Ontario, I do wish to compliment you on your web site, and professional approach to your clients...

I like your web site, the questions and answers....especially what you promise to deliver

We are listed for sale here in Victoria, and I am very very discouraged and now that I have read about you approach to listing and selling a home for your client.....I am thinking things over more....The feedback from a viewing is very helpful to a client....getting no reply back is very disheartening, and we have had aproximately 6 or 7 viewings in the past few months, and I have never heard back from my agent.

We thought we chose the best agent in Victoria, and I have just reread the 5 Truths... http://www.mississauga4sale.com/5truths.htm it enlightens me more Especially Truth #1... I know it is a tough market..but homes are still selling....Our property is rare for our area, its waterfront on a lake in an up and coming area., with revenue potential in several ways, and has several options for the future...

..I know the purchaser decides on the price, and I am astounded our agent wants to lower it yet again..and seldom do we hear from him unless it is to lower the price

.

ANYONE CAN SELL A CORVETTE AT HALF PRICE....however, a clever salesman gets the highest dollar he can to get the highest commission, which is his final goal...

Anyway I have taken up too much of your valuable time....thank you for this valuable information on your web site;....

Good luck to you I am sure your clients have had good results.

G

my response back to this person was:

Thursday, March 26, 2009

Pre-Foreclosures in GTA - do they exist?

Hi Mark,

Do you have any thing on pre-foreclosures?

Do you have properties where there can be discounts of 30 to 50%?

Of course there has to be room for profit;foreclosure don't work so well that way or do they?

Are you able to provide the deep discount properties?

Thanks Mark,

GG

Hello GG,

Wednesday, March 25, 2009

Pre Power of Sale Properties question and answer

Tuesday, March 24, 2009

Interest rates, what's best Fixed vs. variable... a different story

However, that was then, this is now. With the discounted variable rates being a thing of the past (it may be something that we will not see for many years to come) and variable rate mortgages now being offered at a premium, the gap between variable and fixed rates is now much smaller.

So am I saying that you should go fixed? Not necessarily. You will experience an immediate savings with the variable rate, as always in the past, and most variable rate products allow you to switch to a fixed at anytime without penalty. Going the variable rate route at this day and age, is much more risky than it has been in the past. A

nyone going with a variable rate must be prepared to switch at some point within the next year to two years when rates start going back up again in order to benefit from any savings. For this reason, I suggest this product only for the more financial savvy mortgage seekers. For homeowners who would rather get into a mortgage and not have to worry about it for the next 5 years, the fixed rate will be the better, safer option.

We anticipate one more rate drop of 25 basis points (1/4%) during the next interest rate announcement from the Bank of Canada on April 21rd which will most likely be the last prime rate drop we see. Can it really go much lower? Bank of Canada Prime rate is currently sitting at .5%

Fixed rates are continuing to drop with a 5 year fixed now as low as 4.07%! WOW!

Today's lowest rates are as follows:

1 year fixed 3.25%

2 year fixed 3.89%

3 year fixed 3.99

4 year fixed 4.15%

5 year fixed 4.15%

5 year fixed 4.07% (30 day quick close)

5 year variable 3.30% (prime + 0.8%)

Thanks

Mark

I hope this finds you Happy and Healthy!

All the Best!

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

Thinking of Selling? Best Mortgage Rates Current Home Prices Search MLS Newsletter

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

( BUS 905-828-3434

2 FAX 905-828-2829 ÈCELL 416-520-1577

› E-MAIL : mark@mississauga4sale.com

Website : Mississauga4Sale.com

- Thinking of selling your home in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

- Power of Sales and Foreclosures

- If you have not already signed up to receive my monthly real estate newsletter, you may do so here: On-Line Real Estate Newsletter sign up

- See seasonal housing patterns

- Would you like me to send you a 2009 Calendar?

Friday, March 20, 2009

Mortgage Interest Rate update

I hope this finds you happy and healthy!

Mark

| TERM | POSTED | Achievable RATES* |

| 6 Month | 5.20% | 5.00% |

| 1 Year | 4.50% | 3.25% |

| 2 Year | 5.00% | 3.79% |

| 3 Year | 5.20% | 3.74% |

| 4 Year | 5.44% | 3.94% |

| 5 Year | 5.55% | 3.82% |

| 7 Year | 6.80% | 4.95% |

| 10 Year | 5.80% | 5.25% |

| Variable Rate | 3.25% | |

| Prime Rate | 2.50% | |

* Rates may vary and are subject to change without notice.

Rates Last Updated: Friday, March 20, 2009

- Interest Rates

- Power of Sale Properties

- Price Trends

- or Search the MLS and more at my website

Thank you for reading my blog and if there is anything else I can help you with please don't hesitate to contact me,

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

Thinking of Selling? Best Mortgage Rates Current Home Prices Search MLS

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

( BUS 905-828-3434

›mark@mississauga4sale.com

8 Website : Mississauga4Sale.com

- Thinking of selling in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

- On-Line Real Estate Newsletter sign up

- See seasonal housing patterns

Tuesday, March 17, 2009

Tim Horton's chances of winning a car!

I just heard on the radio with the Roll up the Rim to WIN with Tim's that they put more winning cups in BC compared to Ontario

The odds of winning a car in BC are about 1 in 5 million and in Ontario the odds are 1 in 10 million which is about the same odds as you becoming a professional athlete or dating a super model, good luck!

Lol

Mark

Monday, March 16, 2009

Current Mortgage Interest Rates in Toronto Area

Take advantage of today's historically low interest rates.

There's no better time to consider purchasing your first home, renewing your mortgage, or planning that home renovation you've been thinking of.

| TERM | POSTED | BEST RATES* |

| 6 Month | 5.20% | 5.00% |

| 1 Year | 4.50% | 3.50% |

| 2 Year | 5.00% | 3.99% |

| 3 Year | 5.20% | 4.00% |

| 4 Year | 5.44% | 4.14% |

| 5 Year | 5.79% | 4.12% |

| 7 Year | 7.00% | 6.00% |

| 10 Year | 7.35% | 6.35% |

| Variable Rate | 3.25% | |

| Prime Rate | 2.50% | |

* Rates may vary and are subject to change without notice.

Rates Last Updated: Thursday, March 12, 2009

- Interest Rates

- Power of Sale Properties

- Price Trends

- or Search the MLS and more at my website

Thank you for reading my blog and if there is anything else I can help you with please don't hesitate to contact me,

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

Thinking of Selling? Best Mortgage Rates Current Home Prices Search MLS

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

( BUS 905-828-3434

›mark@mississauga4sale.com

8 Website : Mississauga4Sale.com

- Thinking of selling in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

- On-Line Real Estate Newsletter sign up

- See seasonal housing patterns

Sunday, March 15, 2009

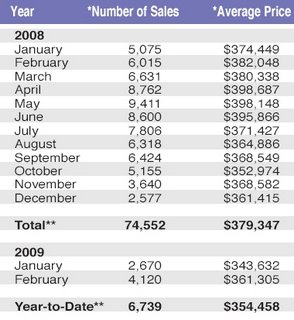

TREB reports Number of listings is up, time on market is up and numer of sales down

The chart above shows that our market is still soft compared to his time last year.

A. Mark Argentino, Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc., Brokerage

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS. 905-828-3434

FAX. 905-828-2829

E-MAIL: mark@mississauga4sale.com

Website: Mississauga4Sale.com

Saturday, March 14, 2009

Economy poised for recovery this year

The Bank of Canada announced Another 50 bps trimmed off the policy rate and talk about adding quantitative easing to the mix.

The economy sagged in the fourth quarter and first-quarter reports point to a larger contraction in early 2009.

I tend to agree with the expert financial institutions that current interest rates are low and fiscal stimulus is in the pipeline, setting up for a recovery later this year.

- Interest Rates

- Power of Sale Properties

- Price Trends

- or Search the MLS and more at my website

Thank you for reading my blog and if there is anything else I can help you with please don't hesitate to contact me,

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

Thinking of Selling? Best Mortgage Rates Current Home Prices Search MLS

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

( BUS 905-828-3434

›mark@mississauga4sale.com

8 Website : Mississauga4Sale.com

- Thinking of selling in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

- On-Line Real Estate Newsletter sign up

- See seasonal housing patterns

Friday, March 13, 2009

POS property purchasing something of lower value?

I had another question about power of sale properties and I thought I would share the question and my answer, Mark

Hi Mark,

I've read through your section on Power of Sale & found it very helpful, but I just don't understand this one point & was hoping you can clarify for me - "One saying about Power of Sale Properties is "you get a lower price but it's a lessor product" " - does this mean I may be purchasing something of lower value?

Thanks in advance,

SL

Hello SL,

Thanks for your comment and question. Yes, generally speaking you are purchasing a lesser product. This means that the property you are purchasing may not have window coverings, appliances etc. included and the property could require some renovations or improvements.

In addition to this you are taking more risk such as the seller redeeming before closing, no warranties on anything, buying as is, where is, etc. so you are effectively purchasing a property with less inclusions and higher risk compared to 'regular' properties for sale in the same area. With this said, this is why you will usually be able to purchase a POS at a lower price.

I hope this helps.

Please let me know if you have other questions.

Mark

Thursday, March 12, 2009

Are less people selling or are homes on the market longer, or combination?

Hi Mark,

I have a question. The 50% drop in sales from last year means;1 ) less people are selling(i.e they are holding on to their homes)

2) homes longer on the market( i.e homes are being listed just as much as last year but there is less interest to buy 3) combination of the two.

Thanks,

S.

- There are actually more homes on the market. 50% drop is the actual number of sales year over year.

- Days on market is longer, meaning it's taking on average, about 2 weeks longer to sell a home. Behind this, what they don't tell you, is that sellers are on the market for 2 to 4 weeks, don't sell, reduce price by 5 to 10% and sell, house takes 5 to 7 weeks to sell rather than 2-3 weeks.

- The two situations above are an indicator of a slowing/slow marketplace. Not sure which one came first.

Thank you,

Mark

Wednesday, March 11, 2009

Save over $300 per month on a $300k mortgage with Today's mortgage interest rates!

I hope this finds you Happy and Healthy!

All the Best!

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

Thinking of Selling? Best Mortgage Rates Current Home Prices Search MLS Newsletter

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

( BUS 905-828-3434

2 FAX 905-828-2829 ÈCELL 416-520-1577

› E-MAIL : mailto:mark@mississauga4sale.com?subject=Mississauga

Website : Mississauga4Sale.com

- Thinking of selling your home in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

- Power of Sales and Foreclosures

- If you have not already signed up to receive my monthly real estate newsletter, you may do so here: On-Line Real Estate Newsletter sign up

- See seasonal housing patterns

- Would you like me to send you a 2009 Calendar?

RE/MAX reports on first time buyers

All the best!

Mark

First-time buyers driving force in Canada's residential real estate markets, says RE/MAX

Mississauga, Ontario (March 11, 2009) - A report released today by RE/MAX confirms that entry-level purchasers are now the engine driving home-buying activity in almost every major centre in Canada.

The 2009 RE/MAX First-Time Buyers Report highlighting first-time buying activity in 32 residential housing markets across Canada found that improved affordability is prompting many first-time buyers to get off the fence, out of the rental, and into the market.

Increased inventory and longer days on market coupled with the lowest lending rates ever are presenting opportunities that have not been seen in almost a decade.

While a sense of caution still prevails, more and more first-timers are finding it hard to pass up the chance to become homeowners in today's buyer-centric real estate climate.

The new reality is that homeownership remains well within reach for most first-time buyers."

"While the current economic crisis has caused some first-time buyers to either take it slowly or apply the brakes, home ownership remains a top priority for those who are able to take advantage of reduced carrying costs, rock bottom interest rates and lower house prices," explains Michael Polzler, Executive Vice President and Regional Director, RE/MAX Ontario-Atlantic Canada. "Affordability has greatly improved and buyers are firmly in the drivers' seat in just about every market we surveyed.

Other banks around the world are following the Bank of Canada

thanks

Mark

Highlights

Canada's economy crumbled in

late 2008, with real GDP contracting

at the fastest pace in 17 years.

The slumping labour market and

housing slowdown point to the

economy continuing to contract in

the first half of 2009.

The Bank cut the policy rate

again in early March and said it is

considering implementing quantitative

or credit easing to ensure

that monetary policy stimulus is

adequate.

The Bank of England (BoE) and

ECB also trimmed their policy rates

and the BoE launched a quantitative

easing program.

BoE cuts rates; announces quantitative easing plan

The BoE cut the policy rate by 50 basis points in early March to 0.5% and announced that it would purchase financial assets financed by the issuance of reserves. The details of the plan showed the BoE intends to buy both corporate debt and government bonds, with the majority of assets purchased being medium and long-term Treasury debt.

Recessionary conditions, globally and in the U.K., were deemed to threaten an undershooting of the 2% medium-term inflation target necessitating the aggressive policy actions.

In the Eurozone, the ECB cut its policy rate by 50 basis points to 1.5%, the lowest in its 10- year history. While there was no overt talk of quantitative easing, ECB President Trichet did not rule out using new "non-standard measures" as forecasts for growth and inflation were cut back.

Tuesday, March 10, 2009

Real estate prices recovered in February 2009 compared to January 2009

A. Mark Argentino, Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc., Brokerage

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS. 905-828-3434

FAX. 905-828-2829

E-MAIL: mark@mississauga4sale.com

Website: Mississauga4Sale.com