Hello from Fabulous Mississauga!

The latest numbers have just been reported from TREB for last months (May 2017) real estate marketplace.

As expected, the number of MLS listings are up by over 42% and the number of sales were down by 26%

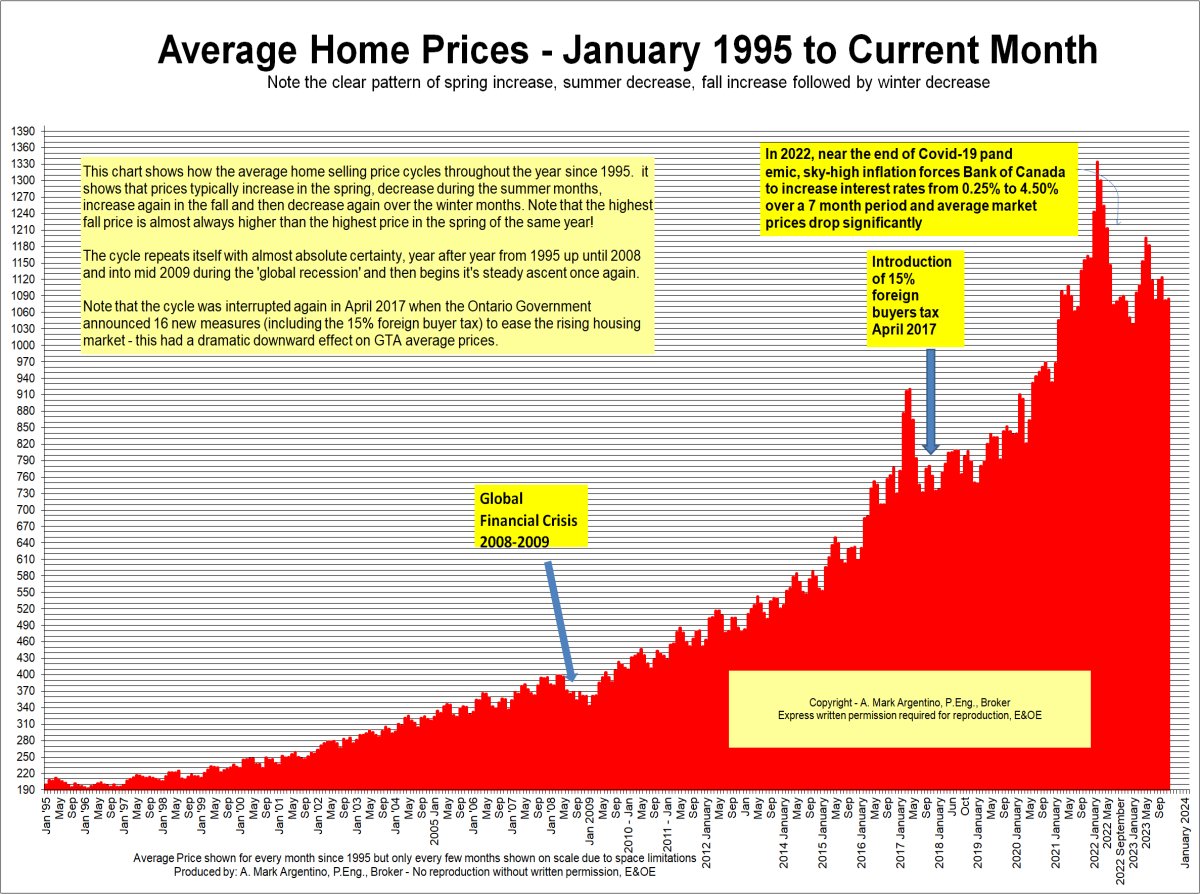

Average prices year over year were up BUT the average price dropped from $919,614 in April to $863,910 in May. This is highly unusual for average prices to drop in the period April to May. Generally the average price increases during this period and has increased over the past 8 years except in 2012 where it dropped marginally. This year the drop from April to May was about 6%

See the graph of average prices by clicking the image below.

The full report is below

I wish you all the best!

Mark

Active Listings Increase in May

TORONTO, June 5, 2017 – Toronto Real Estate Board President Larry Cerqua announced that Greater Toronto Area REALTORS® reported 10,196 sales through TREB’s MLS® System in May 2017 – down by 20.3 per cent compared to 12,790 sales reported in May 2016.

Sales of detached homes were down by 26.3 per cent. Sales of condominium apartments were down by 6.4 per cent.

Active listings – the number of properties available for sale at the end of May – were up by 42.9 per cent compared to the lowest level in 15 years recorded in May 2016, but remained below the average and peak during that period. The number increased considerably for low-rise home types including detached and semi-detached houses and townhouses. Active listings for condominium apartments were down compared to May 2016.

“Home buyers definitely benefitted from a better supplied market in May, both in comparison to the same time last year and to the first four months of 2017. However, even with the robust increase in active listings, inventory levels remain low. At the end of May, we had less than two months of inventory. This is why we continued to see very strong annual rates of price growth, albeit lower than the peak growth rates earlier this year,” said Mr. Cerqua.

Selling prices continued to increase strongly in May compared to the same month in 2016. The MLS® HPI Composite Benchmark price was up by 29 per cent year-over-year. The average selling price for all home types combined for the TREB Market Area as a whole was up by 14.9 per cent to $863,910. Year-over-year price increases were greater for condominium apartments compared to low-rise home types.

This likely reflects the fact that the low-rise market segments benefitted most from the increase in listings.

“The actual, or normalized, effect of the Ontario Fair Housing Plan remains to be seen. In the past, some housing policy changes have initially led to an overreaction on the part of homeowners and buyers, which later balanced out. On the listings front, the increase in active listings suggests that homeowners, after a protracted delay, are starting to react to the strong price growth we’ve experienced over the past year by listing their home for sale to take advantage of these equity gains,” said Jason Mercer, TREB’s Director of Market Analysis.

I hope this finds you Happy and Healthy!

All the Best!

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

BUS 905-828-3434

FAX 905-828-2829 CELL 416-520-1577

mark@mississauga4sale.com

Mississauga4Sale.com