Should I sell my investment property and cash out today - Has the Mississauga or Toronto market peaked?

I get asked this question often. There is no simple answer.

I know how you feel that it's tempting to cash out, prices are so high. This is a difficult question to answer precisely as really, nobody can predict what will happen in the future. Many are now thinking that the market may have peaked in the GTA, but only time will tell.

There have been a few articles written in the press lately about the over-abundance of condos currently on the market and more coming on stream in the next 2 to 3 years. This could potentially create a supply problem and prices could soften in the condo market. Regardless, if you have equity in your investment property, then I would understand that you may wish to take out the equity and move it to other investments that may give you a higher return over the next 5 years or so.

Over the past 3 to 5 years or so the rental market in Mississauga has been very soft and I have noticed the quality of tenants has dropped significantly. This is due to our extremely low interest rates and many people that would have otherwise rented, purchased instead. The vacancy rate in the GTA is very high and this has impacted investment properties.

I help clients with many of their rentals per year and I am finding it much more difficult to find good quality tenants over the past few years.

Even if we have a correction in our market, I don't think it will be too significant. We are not in a boom similar to the investor fuelled boom of the mid to late 80's so I think (and hope) that we will not ever see the bottom fall out of the market the way we did in '89 to '95.

So there you have it. I am sorry I cannot predict the market more accurately for you. When push comes to shove, you will have to make the final decision.

See how average prices have escalated since 1995, we may be near the end of a 10 year increase. http://www.mississauga4sale.com/TREBprice.htm#graph

All the best, and if you want more information, please email me.

Mark

Back to FAQ's in real estate http://www.mississauga4sale.com/FAQ-Real-Estate-Mississauga.htm

Thursday, October 27, 2005

Mississauga Gasoline prices below 90 cents per litre

I guess it was only a matter of time, but the gasoline prices in Mississauga are yo-yo 'ing again, but at least they seem to be heading down as opposed to up!

On October the 8th, prices were in the mid 90's and we all thought we had hit the jackpot.

The photos below show prices under 90 cents per litre, actually saw a price at 88.8 cents per litre.

Two nights ago I was coming home from two late appointments and saw the price on October 25th at the Petro Canada at the corner of Cawthra and Rathburn at 80.4 cents per litre. Yes, you are reading that correct, 80.4 Today, I drove past the same station and the price was back up to 89.9 cents per litre.

All the best,

Mark

On October the 8th, prices were in the mid 90's and we all thought we had hit the jackpot.

The photos below show prices under 90 cents per litre, actually saw a price at 88.8 cents per litre.

Two nights ago I was coming home from two late appointments and saw the price on October 25th at the Petro Canada at the corner of Cawthra and Rathburn at 80.4 cents per litre. Yes, you are reading that correct, 80.4 Today, I drove past the same station and the price was back up to 89.9 cents per litre.

All the best,

Mark

Labels:

real-estate-strategies,

resources

Wednesday, October 19, 2005

Current State of the Real Estate Market in Mississauga

September seemed to be a continuation of the great summer market and it appears we should be in for a strong fall market. It is difficult to predict where the prices will go, (can they go any higher?) but, if patterns over the past years are any indication, prices will escalate again this fall.

Seems the prediction above that I wrote last week came true. Now that the September sales numbers are in the record books, you can read more about the increase in sales last month in this article.

I hope that everything is going well for you and that you receive this in good health.

I wish you all the best! Mark

7,000 Plus! September Home Sales Break Record

Wednesday, October 5, 2005 -- The Toronto Real Estate market continued its record breaking ways in September, with 7,326 sales transacted through the TorontoMLS system, Board President John Meehan reported today. "This figure is up 11 per cent over last year (6,588 sales), and up eight per cent over sales in September 2003 (6,751), which was our previous best September."

The President went on to note that, with 66,480 sales year-to-date, 2005 has closed to within a single percentage point of the 2004 nine-month total (66,668). "If the fourth quarter market performs as well as the previous three months," said Mr. Meehan, "there is a strong possibility that 2005 could end up as the best year ever."

The President went on to note that prices strengthened considerably in September, with the average rising five per cent to $338,267 over the August figure of $323,255. In addition, the year-to-date average, at $335,267, is up seven per cent over 2004.

Labels:

real-estate-strategies,

resources

Saturday, October 15, 2005

Mississauga gasoline prices over the past few years with pictures

Mark Argentino Mississauga Real Estate Blog

Mississauga gasoline prices over the past few years

This page is for fun and interest. You may click any of the photos below for a full size and more detailed picture.

I know that you likely have gone through the same emotional swings as you have watched the gasoline prices "yo-yo" for the past years and escalate to incredible peaks in the recent past. I have started to keep an eye on prices as they reach these unprecedented levels and will report them below.

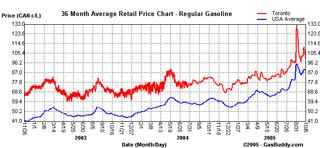

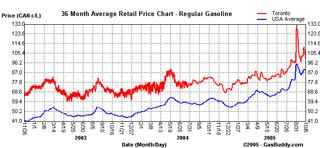

As well, you will find a glimpse of prices around the world on this page and graphs showing how much more we are paying for gasoline compared to the average US price.

Enjoy.

I took this picture the first time that I had ever seen gasoline over 70 cents per litre at the corner of Erin Mills Parkway and Credit Valley Road, the date was October 27, 2003 the price that day was 71.1 cents per litre. I still recall how astonished I was that the price had gone over 69.9

As an aside, I fill up at Esso about 95% or more of the time. The reason for this is multifold.

Less than 2 years later and for the first time I saw gas at the corner of Erin Mills Parkway and Credit Valley Road over $1 per litre was on August 13, 2005 with the price posted at 101.9 cents per litre. Poor Esso across the street had to blank out their large sign and their price was posted on the small A frame board at the side of the road. I was amazed to see this high price and absolutely outraged at the same time.

_________________________________________________________

Hurricane Katrina made landfall in late August of 2005 and caused gas prices to escalate and in late September then Hurricane Rita made landfall on September 24th of 2005 and prices began to rise up to the stratosphere! This sign is from a gas station in Quebec.

Days during Rita making landfall it was reported on ontariogasprices.com that the price fro a litre of gasoline was$1.76 per litre at Port Colborne Shell Gas station. People in my office and my wife's office were reporting that gasoline on the morning of September 23rd was $2 per litre in Barrie and by the afternoon of Friday the 23rd of September prices were heard to be as high as $2.50 per litre at some stations.

This is from August in the USA. Too bad the people from the US don't realize what a great deal they are getting, at USD$2.33 per US gallon, and if 1 gallon [US, liquid] = 3.7854118 liters and the dollar conversion is 1.00 US dollars = 1.17 Canadian dollars that works out to about

The price of USD$2.33 per US gallon is about CAD$2.73 per US gallon and divided by 3.7854118 liters per US gallon equals CAD$0.72 per litre, that's worth repeating, 72 cents per litre, what is so 'unreasonable' about that price

This is from a sign in Germany, price is Euro per litre, at a conversion of 1.00 Euros = 1.40 Canadian dollars this would be about CAD$135 per litre for regular, about CAD$1.79 for super

Now this is about where I would like to see our gasoline prices!

On Friday October 6th, 2005 the prices around Mississauga were all below $1 per litre again, in the high 90's. We all felt as if we were getting the deal of the decade

Toronto Gas Prices

This chart shows the average Toronto gas prices compared to the average gas prices in the USA for the 3 months surrounding the hype and hysteria of the late summer and early fall of 2005

Gas prices over the past 3 years

This picture shows the price on October 8th, 2005. It shows the price at the corner of Credit Valley Road and Erin Mills Parkway Esso at 95.5 cents per litre.

I have not logged the actual prices on Friday's or weekends compared to during the week, but my feeling is that gas stations often will raise the price on a Friday and keep prices high until at least Sunday morning. This is even more true for a long weekend, the price of gasoline usually is raised and stays high for any long weekend that I remember over the past few years. I cannot recall a long weekend where prices dropped, until the weekend of Thanksgiving in 2005.

It's incredible and just goes to prove that just when you think you have the yo-yoing of gasoline prices figured out, "they" go ahead and throw us another curve ball.

To be continued with more current information in the future

Your comments, questions and suggestions are always welcome!

So there you have my 5¢ worth! What are your preferences and reasons for using one gasoline station over another, price, convenience or other? I would love to hear your opinions on this subject too,.

Mississauga gasoline prices over the past few years

This page is for fun and interest. You may click any of the photos below for a full size and more detailed picture.

I know that you likely have gone through the same emotional swings as you have watched the gasoline prices "yo-yo" for the past years and escalate to incredible peaks in the recent past. I have started to keep an eye on prices as they reach these unprecedented levels and will report them below.

As well, you will find a glimpse of prices around the world on this page and graphs showing how much more we are paying for gasoline compared to the average US price.

Enjoy.

I took this picture the first time that I had ever seen gasoline over 70 cents per litre at the corner of Erin Mills Parkway and Credit Valley Road, the date was October 27, 2003 the price that day was 71.1 cents per litre. I still recall how astonished I was that the price had gone over 69.9

As an aside, I fill up at Esso about 95% or more of the time. The reason for this is multifold.

- Back when Esso originally introduced the speedpass (I think it was 1999) I thought that the convenience of pointing an object connected to my key ring was much better than going into the store to pay with a credit card.

- As well, the speedpass was connected to my Visa and I would get Esso points and Visa points at the same time. Since I am on the road very often, as you know I am a real estate agent, I put about $2500 to $3000 of gasoline in my vehicle per year and I thought that the points would add up over the years.

- Another reason for using Esso is that there is an Esso located at the corner of Credit Valley Road and Erin Mills Parkway, about .4 km from my house. Again, very convenient.

- Another reason for me going to Esso (in general) is that they have Royal Bank banking machines and I bank with the Royal, so cash withdrawals were convenient. For anyone who lives north of Dundas or south of Britannia in the Erin Mills Area knows, there are zero branches of the Royal Bank (BTW-as an other aside, RBC is installing a branch near the corner of Eglinton and Plantation Woods - yeah!) in this entire area, so Esso is the most convenient location to obtain cash. This is called cross marketing by Esso and it brings in many customers who would otherwise go to competitor gas stations were it not for the Royal Bank banking machines.

- Probably, one of the most important reasons that I go out of my way to use Esso is the fact that they have Tim Horton's coffee. Many would agree with this fact and this is likely the number one reason why a large percentage of customers fill up with gasoline at Esso, Tim Horton's and convenience. Again, brilliant cross marketing on the part of Esso.

Less than 2 years later and for the first time I saw gas at the corner of Erin Mills Parkway and Credit Valley Road over $1 per litre was on August 13, 2005 with the price posted at 101.9 cents per litre. Poor Esso across the street had to blank out their large sign and their price was posted on the small A frame board at the side of the road. I was amazed to see this high price and absolutely outraged at the same time.

_________________________________________________________

Hurricane Katrina made landfall in late August of 2005 and caused gas prices to escalate and in late September then Hurricane Rita made landfall on September 24th of 2005 and prices began to rise up to the stratosphere! This sign is from a gas station in Quebec.

Days during Rita making landfall it was reported on ontariogasprices.com that the price fro a litre of gasoline was$1.76 per litre at Port Colborne Shell Gas station. People in my office and my wife's office were reporting that gasoline on the morning of September 23rd was $2 per litre in Barrie and by the afternoon of Friday the 23rd of September prices were heard to be as high as $2.50 per litre at some stations.

This is from August in the USA. Too bad the people from the US don't realize what a great deal they are getting, at USD$2.33 per US gallon, and if 1 gallon [US, liquid] = 3.7854118 liters and the dollar conversion is 1.00 US dollars = 1.17 Canadian dollars that works out to about

The price of USD$2.33 per US gallon is about CAD$2.73 per US gallon and divided by 3.7854118 liters per US gallon equals CAD$0.72 per litre, that's worth repeating, 72 cents per litre, what is so 'unreasonable' about that price

This is from a sign in Germany, price is Euro per litre, at a conversion of 1.00 Euros = 1.40 Canadian dollars this would be about CAD$135 per litre for regular, about CAD$1.79 for super

Now this is about where I would like to see our gasoline prices!

On Friday October 6th, 2005 the prices around Mississauga were all below $1 per litre again, in the high 90's. We all felt as if we were getting the deal of the decade

Toronto Gas Prices

This chart shows the average Toronto gas prices compared to the average gas prices in the USA for the 3 months surrounding the hype and hysteria of the late summer and early fall of 2005

Gas prices over the past 3 years

This picture shows the price on October 8th, 2005. It shows the price at the corner of Credit Valley Road and Erin Mills Parkway Esso at 95.5 cents per litre.

I have not logged the actual prices on Friday's or weekends compared to during the week, but my feeling is that gas stations often will raise the price on a Friday and keep prices high until at least Sunday morning. This is even more true for a long weekend, the price of gasoline usually is raised and stays high for any long weekend that I remember over the past few years. I cannot recall a long weekend where prices dropped, until the weekend of Thanksgiving in 2005.

It's incredible and just goes to prove that just when you think you have the yo-yoing of gasoline prices figured out, "they" go ahead and throw us another curve ball.

To be continued with more current information in the future

Your comments, questions and suggestions are always welcome!

So there you have my 5¢ worth! What are your preferences and reasons for using one gasoline station over another, price, convenience or other? I would love to hear your opinions on this subject too,.

Labels:

real-estate-strategies,

resources

Monday, October 10, 2005

Switched blog to my server

Mark Argentino Mississauga Real Estate BlogI just switched my blog to my server at bluehost.com not sure if this is better, but I imagine it likely is. Does anyone know if this is preferred over having my blog at a fee hosted site?

Happy Canadian Thanksgiving!

Thanks,

Mark

Happy Canadian Thanksgiving!

Thanks,

Mark

Labels:

real-estate-strategies,

resources

Sunday, October 09, 2005

TREB (Toronto Real Estate Board) Average Single Family Historical Home Prices and trends for Toronto and Mississauga

TREB (Toronto Real Estate Board) Average Single Family Historical Home Prices and trends for Toronto and Mississauga

Graph of TREB Prices

7,000 Plus! September Home Sales Break Record

Wednesday, October 5, 2005 -- The Toronto Real Estate market continued its record breaking ways in September, with 7,326 sales transacted through the TorontoMLS system, Board President John Meehan reported today. "This figure is up 11 per cent over last year (6,588 sales), and up eight per cent over sales in September 2003 (6,751), which was our previous best September."

The President went on to note that, with 66,480 sales year-to-date, 2005 has closed to within a single percentage point of the 2004 nine-month total (66,668). "If the fourth quarter market performs as well as the previous three months," said Mr. Meehan, "there is a strong possibility that 2005 could end up as the best year ever."

The President went on to note that prices strengthened considerably in September, with the average rising five per cent to $338,267 over the August figure of $323,255. In addition, the year-to-date average, at $335,267, is up seven per cent over 2004.

Below is a Graph showing TREB Historical Average Price Data

The graph below shows a graph of sales price data obtained directly from the Toronto Real Estate Board showing the average selling price of single family homes from 1985 to date in our GTA marketplace.

Note the historical trends for spring and fall price increases, where spring typically has a larger increase compared to the fall.

The benchmark for changes in price is chosen to be the average price of homes at the last height of the market, which was $273,698 in 1989.

If you want the actual values of prices for every month going back to January 1995, I have them, and would be pleased to E-mail them to you upon request.

See the Average Price Cycles from January 1995 to Date - a very interesting cyclical pattern is clearly seen!

You may also see the average mortgage interest rates back to 1979

Send Mark a request for the actual prices of homes since 1995 or you can call Mark now at 905-828-3434

Labels:

real-estate-strategies,

resources

Another test of my blog on Sunday

this is another test of my bog posts

template bottom

Labels:

real-estate-strategies,

resources

Labels:

real-estate-strategies,

resources

Mark Argentino's Mississauga Real Estate Blog

This is a test of my new blog,

Mark

Mark

Labels:

real-estate-strategies,

resources

my first blog post

Hello. This is my first post, not sure if I know what to do, but here goes.

I will attempt to put my thoughts and ideas and feelings into this blog over the weeks and years to come.

Thank you,

Mark

I will attempt to put my thoughts and ideas and feelings into this blog over the weeks and years to come.

Thank you,

Mark

Labels:

real-estate-strategies,

resources

Subscribe to:

Posts (Atom)