Right Timing the Sale

If you are thinking about selling your house, you may want to do some planning now before you are ready to get your house listed on the market. This way, you can know what to expect and how long it will take. You will also have knowledge of when the best time to sell your house will be.

When interviewing Real Estate Agents in the GTA and Mississauga in order to decide who you should hire, make sure to ask them when the best time to sell is. If you have no time constraints, you may want to target the Spring Real Estate Market. However, be sure that you know when that is.

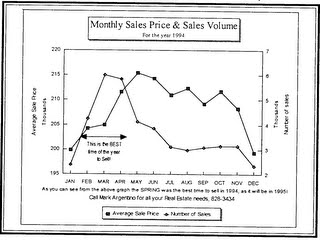

Good question. When you think of Spring, you think of April showers and May flowers. But in real estate, the spring Market is half over by then. Will you have missed your buyer if you list your house in April or May? Are you still going to get the best traffic, and therefore the best offers, through your house?

Well, maybe. If you are thinking of putting your house up for sale in the Spring, you should think February. February? Yes, February. Actually, the landmark date that you should think of as the beginning of the Spring Real Estate Market is the Super Bowl. That seems to be the time when most people venture out of their houses, are settled back in after the holidays and are starting to get stir crazy. It's also a great time to start getting your house on the market for sale.

Why is February the best month to sell?

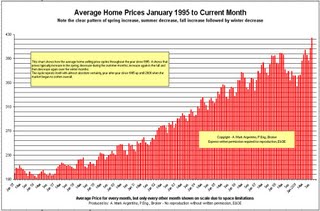

Think about if for a minute. These days, the real estate market is slowing down in many areas. Your house may take several months to sell. Most people want to find a house buy the end of June at the latest so that they can move over the summer when work loads are lighter and kids are not in school.

If you list your house in May and it takes three months to sell, you will find your self in July and in a very quiet market. However, if you list your house in February and it takes three months to sell, you will find yourself in April, with a month or two left in the busiest real estate time of the year. No worries, no pressure.

What time of year are the Buyers Buying?

I sell real estate in Mississauga, Ontario and in my area, we find that the most agreements are written in the months of March and April. You can be sure that the buyers have been looking before they were ready to sign contracts to purchase a home, so that backs us right up to February.

When are the Market Slowdowns?

You have nothing to loose by listing your house for sale in February. In fact, if prices are steady in your area, you can be sure that there are many, many houses for sale. If you get a jump on some of the new listings that will surely be coming on the market for Spring, you may find yourself ahead of falling prices and get more money for your house.

Additionally, when do you think the owners of those houses are waiting for to relist their houses for sale? Spring, of course. Don't you think it will be a good idea to get your house on to the market before there is so much more inventory added to the mix?

Must I sell My House in the Spring?

No. of course not. There are many reasons why other times of the year are great times to sell as well. For example; only serious buyers are house hunting in the winter time, fall market is busy because people want to move during holiday vacation and there is less inventory for sale during the summer months so you may choose this time as a better time to sell

You may find that you can not wait until Spring market and that you have to sell your house at a particular time of year. Don't worry. Find a great realtor and you should get the most that the real estate market has to offer.

Bottom Line, Don't Miss the Spring Real Estate Market

If you are targeting Spring market because you want to make the most out of the sale of your house, or if you are waiting for Spring to put your house on the market for sale, don't wait too long. You may just find out that the Spring real estate market has sprung without you.

I hope you have found this article helpful

Mark