Heated Spring real estate market forecast from coast-to-coast.

Higher housing values, tight inventory levels, and all-out bidding wars have yet to deter first-time buyers in their quest to realize homeownership in major Canadian centres this year, according to a report released today by RE/MAX.

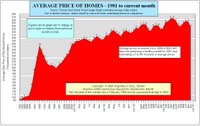

Despite a decade of year-over-year price increases, compounded by challenging market conditions this year, entry-level buyers continue to be a driving force in real estate. Their undaunted enthusiasm is expected to translate into sales at or ahead of last year’s record levels in the Spring.

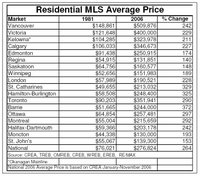

The RE/MAX Affordability Report, which highlights first-time buying activity and trends in 13 housing markets across the country, found that substantial price increases have had little impact on buyer intentions. The greatest year-over-year price appreciation occurred in Edmonton, Calgary, Saskatoon, and Kelowna, where averages rose 52, 29, 26, and 23 per cent respectively. Average price in the country’s most expensive market – Greater Vancouver – has jumped 11 per cent, topping the half million-dollar mark. While prices in these markets may now seem costly, entry-level product such as condominiums can start at half the average price.

Buyers are finding the means necessary to enter the market, even in the western provinces, where double-digit price gains have been reported and sales to listings ratios hover above the 80 per cent mark. Purchasers simply refuse to be priced out of the market, even though household income has not kept pace with housing appreciation. Something’s got to give -- and the trends identified in this report show it’s the how, what, where and when of the equation.

Case in point is the surge in condominium sales from coast-to-coast. Affordability and accessibility have made the condominium lifestyle a popular choice. Condominiums now represent just under one in every two sales in markets like Vancouver and Victoria. In Edmonton, Calgary, and the Greater Toronto Area, close to one in every three sales involve a condominium apartment or town home. In smaller markets like Saskatoon, Regina, and Winnipeg, condominiums are gaining momentum. Condominium sales represent approximately 12 per cent of total residential sales in Halifax-Dartmouth and Ottawa.

Low interest rates and solid economic performance in most major Canadian centres have also played a substantial role in providing purchasers with the confidence to go out and buy their first home. Yet, in some centers, there are other motivating factors at play. Price increases, for example, are a reality in the marketplace. One year can set you back – from location to house size – and your dollar just doesn’t have the same purchasing power.

Yet, buyers have found inventive ways to address that as well. Innovative financing has allowed a growing number of first-time buyers to enter the marketplace. With most prepared to up the ante to realize “the dream of homeownership”, unique new mortgage products with longer amortization periods are helping to make mortgage payments easier to carry.

The offloading of family wealth and inheritance are also factors influencing the up swell in home-buying activity. Some first-time buyers are digging into RRSPs and borrowing money from parents, while others are looking to offset carrying costs through in-law suites, now factored into debt service ratios by a growing number of lending institutions.

You may use this link to download and read the entire report

For more information please contact A. Mark Argentino

A. Mark Argentino, Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc., Brokerage

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS. 905-828-3434

FAX. 905-828-2829

E-MAIL: mark@mississauga4sale.com

Website: Mississauga4Sale.com