I received a nice email from a regular reader of my newsletter and website. I've removed his name, but kept the content. He asks some important questions about our marketplace and I've put my answers below.

Enjoy!

Hey Mark,

First, many thanks for your ongoing posting of stats for the 905 area.

It's a great service to your clients, and indeed to the public at large. I've been following your site for a while, and I notice you've not updated your chart of average prices

(

http://www.mississauga4sale.com/TREBprice.htm) since August and that your estimate for future prices still assumes a 4% increase per year into the future.Since your last chart update, I think it's clear that the cyclical pattern shown has been broken to the downside. Based on a macroeconomic outlook, with recession in the US sure to cause job loss and recession in Canada, there seems to be no catalyst on the horizon to return sentiment to the upside. Sentiment has clearly turned south, and several years or more of declining house prices can be expected, based on examination of previous deflationary periods, absent something to turn it around.

Though you do post the TREB releases, I think it would do your prospective clients a service to update the chart with more recent data showing the trend break. Of course your chart projecting future prices looks like it's a once-per-year update, so it makes sense to hold that off until January, though I do hope you won't assume 4% annual price increases, given the turn in the market.

Cheers,

J. - regular reader.

Hello J,

Thank you for your email and kind comments.

I update my graphs every month, but it appears you are correct, that the graphs are showing old data. Maybe something happened the last time that I synchronized my data. I will recheck and upload the current graphs.

As you have pointed out, I update my newsletter and information monthly, so I am not sure what happened with the graph updates.

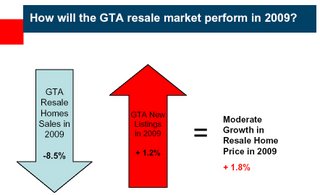

Yes, sentiment has reversed. Actually, our market has been softening since last November, just that it's really starting to hit harder now. I know that I am the eternal optimist, but I feel there is much positive in our current marketplace. I believe the next two quarters will be a difficult time here in the GTA and beyond that, nobody knows. I blogged a little about our softening market at this page:

http://www.mississauga4sale.com/blog/2008/11/mississauga-and-gta-real-estate-market.htmlAnd yes, I 'predict' once per year and I would guess that 4% is definitely not in the cards for 2009 My observations are this, and you may concur. TREB has always seemed to skew their statistical results to portray a positive and optimistic picture when they release market stats every month. I feel their market analysis is for the media rather than the membership, but I think that is part of their job, to keep the real estate ball rolling. You may have noticed that TREB is now splitting the Toronto market values and figures from the 905 region. This is good and bad. I believe it's good because 905 area is very different compared to the 416 area of Toronto, so the numbers should be broken out to give people a more realistic set of monthly figures to analyse. The bad part is that people (and TREB) still compare year over year figures and now when you do that, the numbers are not comparing apples with apples. Thus, error is introduced into the analysis.

As well, TREB has grown immensely in geographic regions over the past 5 to 10 years. There were very few listings 10 years ago on TREB from Burlington or Whitby or Newmarket, for example. Now, those areas all share data with TREB. Thus, number of sales and average prices have changed a great deal when you add those areas and figures. I feel this makes some of the historical comparisons suspect, if not invalid.

One has to be extremely careful when looking at averages and must make comparisons that are comparable.

At any rate, I thank you for your comments and I will upload the proper updated graphs over the weekend.

Thank you,

Mark