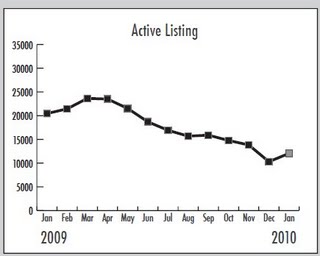

Homes sales in the GTA and Mississauga were slightly higher than the average number of home sales in the past 5 years. If you are a buyer looking for a property right now, you know that our marketplace is very fast right now and almost everything is selling very quick. Average prices are up considerably when you compare January 2010 to January of 2009, but the period from October 2008 to January 2009 was dismal. In fact January of 2009 was the bottom of the slump in our market, the outlook for real estate was dismal. One year later and the outlook is incredibly different, you won't find many people who are not optimistic on real estate in Mississauga and Toronto for 2010All the best,MarkGreater Toronto REALTORS® reported 4,986 transactions through the Multiple Listing Service (MLS®) in January 2010.

This result represented a large increase over the 2,670 sales in January 2009 when the home sales were in a recessionary trough. Last month’s sales were slightly higher than the January average in the five years

preceding 2009.

“The GTA housing market has rebounded well from the lows in sales experienced at the beginning of 2009. Sales climbed back to healthy levels across the GTA because the cost of home ownership remained affordable in the Toronto area,” said TREB President Tom Lebour.

“Increasingly confident consumers moved to take advantage of affordable home ownership.”

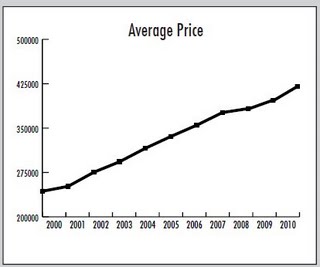

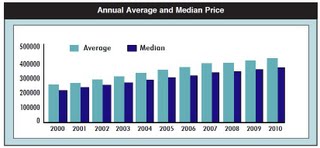

The average home selling price in January 2010 climbed 19 per cent to $409,058, compared to 343,632 in the same month last year.

“Expect strong annual growth rates for existing home sales and average price through the first quarter as we continue to make comparisons to the weak market conditions at the beginning of 2009,” said Jason

Mercer, TREB’s Senior Manager of Market Analysis. “The rate of sales and price growth will be lower