hi!

This may be old news, but read this if you want to see how intricate the scammers are, no wonder they

are successful

http://www.howtogeek.com/180514/the-%e2%80%9ctech-support%e2%80%9d-scammers-called-htg-so-we-had-fun-with-them/

Mark

Friday, October 23, 2015

Wednesday, October 21, 2015

Bank of Canada leaves prime rate at 0.5% on October 21 2015

Hello from fabulous Mississauga!

How about those Jays and their win today? It was so exciting to see them win the 5th game today against the Royals, let's hope they can continue!

Other positive today for the Toronto and Canadian people who have debt is that the Bank of Canada left the prime rate at 0.5%

This means that the Bank Prime Rate stays at .75% and the borrowing rate that you and most Canadians receive stays the same before the announcement at 2.70%

If you want to read the entire press release from the Bank, please use the link below:

Have a Great Day and GO JAYS GO

I hope this finds you Happy and Healthy!

All the Best!

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

BUS 905-828-3434

FAX 905-828-2829 CELL 416-520-1577

mark@mississauga4sale.com

P. Eng. Broker

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

BUS 905-828-3434

FAX 905-828-2829 CELL 416-520-1577

mark@mississauga4sale.com

Mississauga4Sale.com

- Thinking of selling your home in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

http://www.mississauga4sale.com/internet-evaluation.htm - Power of Sales and Foreclosureshttp://www.mississauga4sale.com/Power-Sales-Bank-Sales-Alert-Request.htm

- If you have not already signed up to receive my monthly real estate newsletter, you may do so here: On-Line Real Estate Newsletter sign up

http://www.mississauga4sale.com/popupquestion.htm - See seasonal housing patternshttp://www.mississauga4sale.com/TREBprice.htm

Thursday, September 10, 2015

Record Setting Month in GTA for Average Prices and Sales of Single Family Residential Sales

Once again, last month was another very strong month for sales and prices in the GTA.

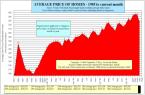

The Average price for last month was $602,607 (it was $609,236 the previous month) and this represents aver a 10.3% increase compared to the same month last year- see graph of prices here

Sales volumes were 7,568 (it was 9,880 last month) and this is UP 5.7% from the same month last year

The Bank of Canada Prime Lending Rate now stands at 2.70% steady (since July 2015) read more

Read more about what happened last month at see last month results and prices here

For more information please contact A. Mark Argentino

A. Mark Argentino, Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc., Brokerage

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS. 905-828-3434

FAX. 905-828-2829

E-MAIL: mark@mississauga4sale.com

Website: Mississauga4Sale.com

The Average price for last month was $602,607 (it was $609,236 the previous month) and this represents aver a 10.3% increase compared to the same month last year- see graph of prices here

Sales volumes were 7,568 (it was 9,880 last month) and this is UP 5.7% from the same month last year

The Bank of Canada Prime Lending Rate now stands at 2.70% steady (since July 2015) read more

Read more about what happened last month at see last month results and prices here

For more information please contact A. Mark Argentino

A. Mark Argentino, Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc., Brokerage

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS. 905-828-3434

FAX. 905-828-2829

E-MAIL: mark@mississauga4sale.com

Website: Mississauga4Sale.com

Wednesday, September 09, 2015

Bank of Canada keeping the target overnight interest rate at .5%

The Bank of Canada announced on September 9th that they are keeping the target overnight interest rate at .5% and this means that the bank rate stays at .75%

see a graph of historical interest rates here:

http://www.mississauga4sale.com/rates.htm

This is the full press release below:

The Bank of Canada today announced that it is maintaining its target for the overnight rate at 1/2 per cent. The Bank Rate is correspondingly 3/4 per cent and the deposit rate is 1/4 per cent.

Inflation has evolved in line with the outlook in the Bank’s July Monetary Policy Report (MPR). Total CPI inflation remains near the bottom of the target range, reflecting year-over-year price declines for consumer energy products. Core inflation has been close to 2 per cent, with disinflationary pressures from economic slack being offset by transitory effects of the past depreciation of the Canadian dollar and some sector-specific factors. The dynamics of GDP growth in Canada outlined in July’s MPR also remain intact. The stimulative effects of previous monetary policy actions are working their way through the Canadian economy.

Canada’s resource sector continues to adjust to lower prices for oil and other commodities, with some spillover to the rest of the economy. These adjustments are complex and are expected to take considerable time. Economic activity continues to be underpinned by solid household spending and a firm recovery in the United States, with particular strength in the sectors of the U.S. economy that are important for Canadian exports.

Increasing uncertainty about growth prospects for China and other emerging-market economies, in contrast, is raising questions about the pace of the global recovery. This has contributed to heightened financial market volatility and lower commodity prices. Movements in the Canadian dollar are helping to absorb some of the impact of lower commodity prices and are facilitating the adjustments taking place in Canada’s economy. While the overall export picture is still uncertain, the latest data confirm that exchange rate-sensitive exports are regaining momentum.

Meanwhile, risks to financial stability are evolving as expected. Taking all of these developments into consideration, the Bank judges that the risks to the outlook for inflation remain within the zone for which the current stance of monetary policy is appropriate. Therefore, the target for the overnight rate remains at 1/2 per cent.

For more information please contact A. Mark Argentino

A. Mark Argentino, Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc., Brokerage

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS. 905-828-3434

FAX. 905-828-2829

E-MAIL: mark@mississauga4sale.com

Website: Mississauga4Sale.com

Wednesday, July 15, 2015

Bank of Canada Announces another rate cut to 0.5% as of July 15

As of July 15, 2015 the Prime Rate was cut to 0.5%

The Bank of Canada announced a drop in the prime rate to 0.5% on July 15 at the latest press conference,

The Bank of Canada is cutting its key interest rate for the second time this year, citing a larger-than-expected first half contraction and a “puzzling” stall in non-energy exports.

The central bank lowered its benchmark overnight rate by a quarter percentage-point Wednesday to 0.5 per cent, blaming faltering global growth, disinflation and low prices for oil and other commodities.

I hope this finds you Happy and Healthy!

All the Best!

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

BUS 905-828-3434

FAX 905-828-2829 CELL 416-520-1577

mark@mississauga4sale.com

P. Eng. Broker

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

BUS 905-828-3434

FAX 905-828-2829 CELL 416-520-1577

mark@mississauga4sale.com

Mississauga4Sale.com

- Thinking of selling your home in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

http://www.mississauga4sale.com/internet-evaluation.htm - Power of Sales and Foreclosureshttp://www.mississauga4sale.com/Power-Sales-Bank-Sales-Alert-Request.htm

- If you have not already signed up to receive my monthly real estate newsletter, you may do so here: On-Line Real Estate Newsletter sign up

http://www.mississauga4sale.com/popupquestion.htm - See seasonal housing patternshttp://www.mississauga4sale.com/TREBprice.htm

Subscribe to:

Posts (Atom)