Is it better to Rent or Own your home?

The Benefits of Home Ownership

Unlike renting, buying a home is an investment that can appreciate over time, giving you more financial security long term. If you are still paying rent to someone else, these numbers may be of interest to you.

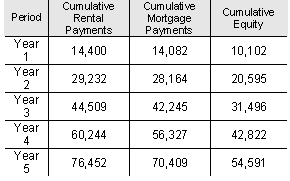

The example that follows is based on these assumptions:

Anticipated Home Price: $ 200,000 Down Payment: $ 0.00

Interest Rate: 5.09% Amortization: 25 yr

Monthly Rent: $1,200 Mortgage Payment: $1,173

Annual Rent Increase: 3.0% Home Value Increase: 3.0%

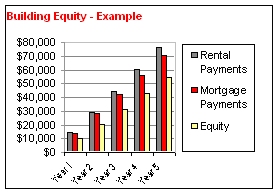

After 5 years, you will have accumulated $54,591 equity in your home. In addition, you will have paid $6,043 less than your rental payments. This chart shows the totals year by year:

*Calculation results are approximations and are for information purposes only. Actual figures may vary. It assumes all payments are made when due. This does not include any additional home ownership expenses i.e. property taxes, heating costs, and condo fees if applicable. Article courtesy of Scotiabank

For more information please contact A. Mark Argentino

A. Mark Argentino Associate Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc.

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS 905-828-3434

FAX 905-828-2829

E-MAIL mark@mississauga4sale.com

Website: Mississauga4Sale.com

Mark,

ReplyDeleteI'm renting a SFH 4 bdrm, in W19, very nice area. I'm paying $1600/mo, that house was listed 1.5 yrs ago for $417k. so following your calculation, with zero down, it would cost $2445/mo in mortgage, plus (1%) taxes $347/mo...that's $2792/mo vs $1600/mo. so I'm saving $1192/mo. that home would hardly fetch the same price today (417k), let alone it's over priced at that level. my rent didn't increase on the second year, I don't have to do maintenance other than fron&back lawn. besides, I'm not sure what you mean by cumulative equity..?, is it appreciation on property?, or the principle paid?

Sphinx

Hello Sphinx,

ReplyDeleteThank you for your detailed comment. To answer your question, 'cumulative equity' is the increase in equity of your property due to the part of your monthly mortgage payment that is credited directly to the principal. Thus, every monthly payment reduces your principal amount outstanding on the mortgage.

It is this equity increase and property value increase over time that gives you the investment.

In your example, if you are taking the $1192 per month and putting it into some sort of savings or investment vehicle, then you will accumulate about $14,000 per year and over time this can be your savings.

I look at it like this. Real estate investment for your principal residence is a 'forced' savings method. It is not necessarily cheaper than renting, but there are many other benefits to ownership that go far beyond the monetary value increase. Read about it here: http://www.mississauga4sale.com/psychology-ownership.htm

If you need more information, please don't hesitate to contact me.

All the best!

Mark