CHMC Rental Housing Market Report Highlights

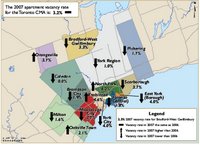

CHMC Rental Housing Market Report Highlights• The average apartment vacancy rate in the GTA was unchanged at 3.2 per cent in October 2007. Average same-sample two-bedroom apartment rents

increased by 1.2 per cent.

• Market conditions remained similar to 2006 because new renter household formation was offset by a movement of existing renter households into homeownership.

• The rental market will experience little change in 2008, with the average apartment vacancy rate at 3.5 per cent and average rents growing by less than the rate of inflation.

Market Conditions in Line With 2006

Rental market conditions in 2007 remained in line with those experienced in 2006. There was no change in the 3.2 per cent average apartment vacancy rate and same-sample

rents grew below the rate of inflation.

It is important to note that there was variation in rental market conditions across the different sub-markets of the GTA.

Market Several factors contributed to stability in vacancy rates in 2007. Increased home ownership demand, especially from the first-time buyer segment of the market, resulted in a substantial number of households vacating their rental accommodation

CMHC Rental Market Outlook for 2008

- Demand for rental housing in 2008 will remain on par with what was experienced in 2007.

- The overall apartment vacancy rate will be 3.5 per cent.

- The average two-bedroom rent will increase by 1.5 per cent.

- The movement to home ownership will continue to be a drag on the rental market, but in a different fashion.

- While both existing and new home sales are forecast to edge slightly lower next year, first-time buyers will continue to vacate rental accommodation in favour of home ownership. This movement, however, will be based on a strong increase in condominium apartment completions in 2008. More than double the number of condominium apartment completions experienced in 2007 will occur next year.

- In addition, investor-held condominium apartments in the secondary rental market will attract some renter households out of the primary rental market, due to a higher level of finishings and amenities.

- Factors that will continue to influence the demand for rental include the following:

- Growth in youth employment will continue due to tight labour market conditions;

- Immigration will continue to trend upward; and

- Rental affordability will continue to improve as household earnings outstrip growth in average

rents.

Read more about rental properties and finding a rental property

Search the MLS or read more about Interest Rates, Power of Sale Properties, Price Trends and more at my website.

Thank you for reading my blog and if there is anything else I can help you with please don't hesitate to contact me,

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

Thinking of Selling? Best Mortgage Rates Current Home Prices Search MLS

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

( BUS 905-828-3434

2 FAX 905-828-2829 ÈCELL 416-520-1577

› E-MAIL : mark@mississauga4sale.com

8 Website : Mississauga4Sale.com

- Thinking of selling in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

- On-Line Real Estate Newsletter sign up

- See seasonal housing patterns

No comments:

Post a Comment