Hi

So here we are again, at the end of another year, actually the end of a

decade and the beginning of a new year. Every year at this time we can look

back and reflect on what has happened in the past year with certainty. Also

at this time of year this is the time that we try and peer into the future

and predict what will happen with far less certainty. In real estate it's

very critical to try and predict the future because so much is relying on

it.

It takes quite a bit of time to condense my thoughts and observations into

this section of predictions for 2010. Part of the reason is that I want to

be as accurate as possible. As well, I know that many people will read this

page and rely on some of the predictions contained herein. Therefore, I

want to give as good advice as possible, advice that is realistic and yet

insightful.

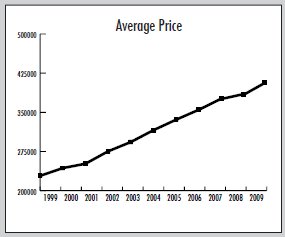

Real estate is one of the few things in our lives that tends to increase in

value year after year after year. There is no certainty with this increase,

but it sure has seemed certain over the past 15 years. Our year over year

average single family residential price has increased every year since 1985,

except the fall of 2008, including this year. Don't believe me, see the

graph here:

http://www.mississauga4sale.com/TREBavg1995date.htmThere are some, many in fact that are predicting that we in the GTA and

especially BC are sitting at the peak and prices are about to crash. Garth

Turner is one person who is predicting that prices are almost guaranteed to

fall in 2010 I don't agree with him and don't feel that our area,

Mississauga and the GTA will fall in the next year.

What do we know with certainty for the future? We know the following is

almost guaranteed to happen in the Mississauga and GTA real estate

marketplace:

* Interest rates will increase in 2010, the Bank of Canada is

currently stating rates will increase in mid 2010 - this will put downward

pressure on prices after rates increase, but will cause many buyers to buy

before the rates increase and anticipation of the increase in rates

* there will be a shortage of listings for at least January and maybe

into February, this is a near certainty based upon the past 22 years for

January and early February, not many people list their homes at these times

- this will cause upward pressure on prices in the fist quarter of 2010

* HST will come into effect July 1, 2010 and this will increase the

cost when selling your home and to a lesser extent increase the cost to the

buyers, this will put slight downward pressure on prices

This is what we know with less certainty:

* the US real estate recovery seems to be happening

* the US and global economy will improve in 2010

* people may perceive that the HST will causes prices to increase once

it comes into effect and try to save some money before July 1st and this

could cause a mini boom in our market in the late spring of 2010

Due to the fall in late 2008, the average price in 2009 compared to 2008 is

up about 12%. We are up about the same percentage comparing 2007 to 2009

This is what I predicted in January for 2009

http://www.mississauga4sale.com/Toronto-GTA-Real-Estate-Market-Predictions-2

009.htm#2009 When I read the predictions I made back in January for 2009 it

makes me think that maybe I should go into the prediction business, more

than 3/4 of the things I predicted came true! I was wrong on Gold and wrong

on Gasoline prices, otherwise my predictions were quite close.

* These are my predictions for 2010 below and also online at this

link:

http://www.mississauga4sale.com/Toronto-GTA-Real-Estate-Market-Predictions-2

010.htm#2010

* I predict that our prices will increase about 4 to 6% in 2010 with

some softening in our market when the Bank of Canada increases rates in the

middle of 2010, once the Olympics end in the first quarter of 2010 and the

'dreaded' HST comes into affect July 1st of 2010

* Mortgage rates will increase beginning about July of this year, the

bank prime rate as of January 1, 2010 is 0.25% and I predict by year end it

will be at 1.00% to 1.50% This means that current mortgage interest rates

will increase by about 1.25% to 2% over what they currently are. This may

sound excessive, but I firmly believe that our economy will bustle this year

and increased rates will be necessary to calm things down a little, plus the

banks will want to gouge a little in light of increasing prime rates. They

often do this when rates are increasing as they can get away with it with

little backlash.

* I still believe you should go short term on your mortgage, read more

here about why I feel this way:

http://www.mississauga4sale.com/Lock-In-Short-Term-Long-Term-Mortgage.htm

* We live in a very vibrant, growth oriented area of North America

with a very diverse economy and culture. People seem to want to work hard

and improve upon their personal and financial situation and almost everyone

I meet is employed and optimistic about the future. This is good for the

local economy and our future.

* No matter what happens, as long as you continue to work hard, save

10% of your gross income, watch what you spend, don't get into too much debt

that you can't handle it should you find yourself with a a job for a few

months, then you should be able to slowly and surely achieve financial

independence.

* The condo market will continue to surge, it's affordable and

desirable

* Bungalow style homes will become more desirable, (they currently are

very desirable), as our population age increases

* Barrel of oil will be $100 at end of year and gasoline will be $1.10

and gold will be $1100 per ounce at end of 2010

* Once again, beware the emotions of

<http://www.mississauga4sale.com/Market-Emotions-Cycle.htm> the marketplace

and stick to your long range goals , currently I believe we are in the

optimism/excitement phase so things may get really hot this spring in the

market.

* I still subscribe to all the values and principles that I've written

about in the past on this page below.

* I am a very optimistic person and always believe that I can do

better by reading and doing things every day that contributes to my long

term goals. I always set high but attainable goals and often come close to

reaching my goals and even if I fall short, I've surpassed what I have done

in the past. I subscribe to many newsletters that preach optimism and

growth and these help me stay sharp and continue to learn. Every day I seem

to learn something new, so at least I'm growing. You can read some of the

ideas that I subscribe to and believe at this page:

http://www.mississauga4sale.com/Motivation-Success-Ten-Scrolls.htm

That's about it for now, keep to your plan invest in real estate for the

long term, you cannot go wrong.

I wish you a very Happy New Year and all the best to you and your family in

2010

Mark