The TSX Index is down about 36% from its high of just over 3 months ago. If you are like me, you are probably a little concerned about your investments in the markets.

If you've been watching the news or reading the papers you might be thinking this is a unique and horrific event. You might also be wondering what you should do in the short and long term.

First, this market meltdown is not unique. There have been 3 bear markets with even steeper losses in recent times including the tech boom and bust from August 2000 through to September 2001 with a decline in the markets of 39%.

As for being horrific and insurmountable – the one common feature of a bear stock market is: they all end and are replaced by bull markets.

If you believe the world will continue to develop and grow; if you believe Canada is well positioned with many of the resources needed to facilitate that growth; if you believe you need to achieve "real" returns in excess of the rate of inflation, you should believe it's time to invest.

There appears to be many opportunities in the financial markets. But, when is the bottom and have we hit it yet and is now the time to invest? My rsp's have dropped about 40% since July of this year, one would say, plow in a pile of cash into the market and reap the rewards over the next year or two. Or is the market still going to continue to drop? Anybodys guess. Some will turn out winners and some losers.

This graph bwlow shows the TSX Index values since January 2000 and you may note that even at today's value, an investment of $100,000 made in September 2001 is now worth about $147,000 – an increase of 47%. Click the graph to see it full size.

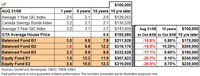

A review of the performance of various investments over the past ten years is quite enlightening. The chart below reflects the ten year period ending August 31, 2008 with an update to October 8, 2008 shown to the right for 5 selected Canadian funds.

The "safe" options have made steady money and continue to do so although the rates of return are quite modest.

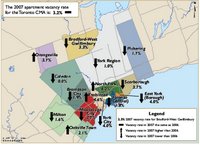

House prices in the GTA have done very well with 12 consecutive years of increasing prices up until the 3% decline recorded this September. It may be that house prices have peaked and it could be a number of years before appreciable increases are seen again. If you are a client of mine, you know that the appreciation of the investment is not critical for a rental property, the tenant is paying off the investment for you. That's your largest return.

Even after allowing for the sharp decrease in market values over the past 3 months, the 5 selected mutual funds have each outperformed both the safe options and the housing option. So, if you've been invested in good quality funds over the past decade you have done well even though you may not feel this way over the past couple of months.

I say it may be the best of times because it looks like a good time to invest. More specifically it looks like a good time to borrow to invest.

· Interest rates are low (Prime + ¾% is available based on credit score only)

· The cost of borrowing is tax deductible

· Some are offering free interest for the first 3 months

Borrowing to invest is not for everyone. It should only be considered by those who:

· Are prepared to commit to a 10 year minimum period

· Are comfortable in their ability to maintain a payment schedule

· Understand it is possible to incur losses in the short and long term.

If you borrowed a $100,000 to invest 10 years ago:

· Total cost of borrowing was $61,700

· The net cost of borrowing was $41,340 (based on a 33% tax rate)

· The taxable capital gain ranged from $75,000 to $165,000

Would you be willing to commit to a net monthly cost of less than $300 for the opportunity to invest $100,000 today?

Or, would you be willing to invest some money into the real estate market where you will gain significantly over the longer term?

The choice is yours to make.

I wish you all the best,

Mark