Activity Will Ease

Strong economic fundamentals have been a driving force for the GTA housing market over the past decade.

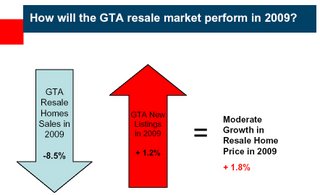

Now faced with a rising unemployment rate and declining labour income growth, households are scaling back expenditures on big ticket items, particularly related to housing. As a result, resale home purchase activity will slow down in 2009. This year, GTA home sales will decline by 21.5 per cent to 60,000 units - the lowest level of existing sales since late 90’s. 2010 should bring signs of recovery and is forecast to be a turning point for the area’s resale housing market. Improving housing affordability, combined with more favorable employment and household wealth situations will gradually entice homebuyers back into the market.

First-time buyers will continue to be a key driver of housing demand this year and next. However, this segment will demonstrate a greater degree of caution while making their home-buying decisions. A deepening economic downturn especially impacts first-time buyers, who tend to have less job security and an inadequate savings cushion to deal with temporary periods of unemployment or underemployment.

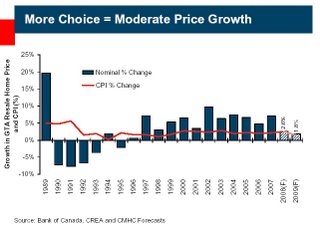

Sales of existing homes peaked in 2007 — around the same time the cost of home ownership hit a new high in the GTA. Over the 2003- 2008 period, the accelerated rise in average resale prices caused the gap between actual household income and the income required to purchase a home in the GTA to narrow. Buyers responded with a much lower level of sales in 2008.

Over the next two years, the expected home price depreciation, stable household earnings growth

and record low mortgage rates should result in more comfortable homeownership conditions. As economic conditions begin to improve next year, buyers are expected to respond to the much improved affordability conditions.

The number of existing home sales in the area is forecast to increase in 2010.

I hope this finds you Happy and Healthy!

All the Best!

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

Thinking of Selling? Best Mortgage Rates Current Home Prices Search MLS Newsletter

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

( BUS 905-828-3434

2 FAX 905-828-2829 ÈCELL 416-520-1577

› E-MAIL : mailto:mark@mississauga4sale.com?subject=Mississauga

Website : Mississauga4Sale.com

- Thinking of selling your home in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

- Power of Sales and Foreclosures

- If you have not already signed up to receive my monthly real estate newsletter, you may do so here: On-Line Real Estate Newsletter sign up

- See seasonal housing patterns

- Would you like me to send you a 2009 Calendar?