Monday, February 01, 2010

$1500 extra taxes due to HST in real estate transactions in Toronto and Mississauga

The HST effectively combines the 8% Provincial Sales Tax (PST) and the 5%

Federal Goods and Services Tax (GST) for a combined 13% sales tax rate known

as the Harmonized Sales Tax (HST).

The HST will apply to a number of goods and services that are currently

exempt.

For housing in Ontario, the HST will add 8% more tax on any services related

to real estate transactions, such as real estate commissions, legal fees,

home inspections and moving costs.

It is estimated by OREA that the HST will add about $1500 in additional

taxes to the cost of the average residential real estate transaction.

It is expected that there will be a surge in sales this spring to avoid the

HST that becomes law on July 1st.

All the best!

Mark

Monday, January 18, 2010

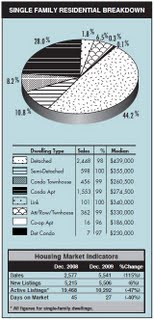

Single family residential snapshot for sales in Toronto Mississauga and GTA Real Estate Marketplace

This graph shows you the percentage of each housing type that was sold last month

For more information please contact A. Mark Argentino

A. Mark Argentino, Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc., Brokerage

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS. 905-828-3434

FAX. 905-828-2829

E-MAIL: mark@mississauga4sale.com

Website: Mississauga4Sale.com

Sunday, January 17, 2010

Housing market indicators for real estate in Toronto Mississauga and GTA Real Estate Marketplace Marketplace

Sales are up 115% for last month compared to same month in 2008

New listings are up slightly 6% compared to same month in 2008

Days on the market is down 40% for December 2009 compared to same month in 2008, indicating a very fast market!

For more information please contact A. Mark Argentino

A. Mark Argentino, Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc., Brokerage

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS. 905-828-3434

FAX. 905-828-2829

E-MAIL: mark@mississauga4sale.com

Website: Mississauga4Sale.com

Saturday, January 16, 2010

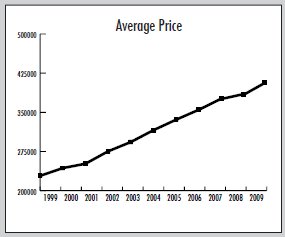

Average single family residential real estate sales prices since 1999 in Toronto Mississauga and GTA Real Estate Marketplace

As the RBC states, past performance is not an indication of future trends... no kidding... but let's hope that this continues for some time to come!

For more information please contact A. Mark Argentino

A. Mark Argentino, Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc., Brokerage

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS. 905-828-3434

FAX. 905-828-2829

E-MAIL: mark@mississauga4sale.com

Website: Mississauga4Sale.com

Friday, January 15, 2010

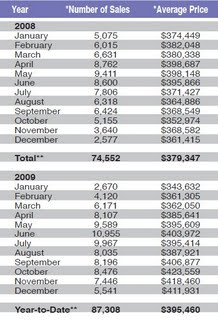

Chart showing 2009 and 2009 average price per month for Toronto Mississauga and GTA Real Estate Marketplace

Prices have increased year over year. you can see the fall in the prices in the fall of 2008 and then the rebound in 2009

For more information please contact A. Mark Argentino

A. Mark Argentino, Broker, P.Eng.,

Specializing in Residential & Investment Real Estate

RE/MAX Realty Specialists Inc., Brokerage

2691 Credit Valley Road, Suite 101, Mississauga, Ontario L5M 7A1

BUS. 905-828-3434

FAX. 905-828-2829

E-MAIL: mark@mississauga4sale.com

Website: Mississauga4Sale.com

Sunday, January 10, 2010

Average annual income of a real estate agent

Too bad that is not the case.

If you take the total number of properties sold on the Toronto Real Estate Board (TREB) last year multiplied by the average selling price and then take 2% commission as the average per side in the transaction then the 'average' agent earned approximately $31,000 in 2009

Median Gross Personal Income of REALTORS®

YEAR | Brokers/ | Sales | ALL REALTORS® |

2008 | $49,300 | $28,400 | $36,700 |

2007 | $65,200 | $31,000 | $42,600 |

2006 | $73,300 | $34,600 | $47,700 |

All the best!

Mark

I hope this finds you Happy and Healthy!

All the Best!

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

Thinking of Selling? Best Mortgage Rates Current Home Prices Search MLS Newsletter

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

( BUS 905-828-3434

2 FAX 905-828-2829 ÈCELL 416-520-1577

› E-MAIL : mailto:mark@mississauga4sale.com?subject=Mississauga

Website : Mississauga4Sale.com

- Thinking of selling your home in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

- Power of Sales and Foreclosures

- If you have not already signed up to receive my monthly real estate newsletter, you may do so here: On-Line Real Estate Newsletter sign up

- See seasonal housing patterns

- Would you like me to send you a 2010 Calendar?

Thursday, January 07, 2010

2009 GTA TREB residential real estate resale home sales up and prices up for year

GTA REALTORS® REPORT DECEMBER RESALE HOUSING MARKET FIGURES

TORONTO, January 6, 2010 -- Greater Toronto REALTORS® reported 87,308 MLS® transactions in 2009 – a 17 per cent increase over 2008. This result included 5,541 sales in December.

The 2009 result was in line with the healthy levels of sales experienced between 2004 and 2006, but lower than the record of 93,193 set in 2007.

“After a slow start to the year, existing home sales rebounded during the second half of 2009,” said TREB President Tom Lebour. “As consumer confidence improved, many households moved to take advantage of affordable home ownership opportunities in the GTA.

The strong residential real estate sector was a key contributor to overall economic recovery in Canada.”

The average home price in 2009 climbed four per cent to $395,460. The average price for December transactions was $411,931.

“Market conditions became very tight in the latter half of 2009. Sales climbed strongly relative to the number of homes listed for sale, resulting in robust price growth that more than offset average price declines in the winter,” said Jason Mercer, TREB’s Senior Manager of Market Analysis. “A greater supply of listings in 2010 will see home prices grow at a sustainable pace.”

I hope this finds you Happy and Healthy!

All the Best!

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

Thinking of Selling? Best Mortgage Rates Current Home Prices Search MLS Newsletter

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

( BUS 905-828-3434

2 FAX 905-828-2829 ÈCELL 416-520-1577

› E-MAIL : mailto:mark@mississauga4sale.com?subject=Mississauga

Website : Mississauga4Sale.com

- Thinking of selling your home in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

- Power of Sales and Foreclosures

- If you have not already signed up to receive my monthly real estate newsletter, you may do so here: On-Line Real Estate Newsletter sign up

- See seasonal housing patterns

- Would you like me to send you a 2010 Calendar?

Thursday, December 31, 2009

Tuesday, December 29, 2009

Almost time to lock in your mortgage

Good long range planning will certainly help you with your future!

This goes against what I have written many times in the past. I've always recommended going short term on your mortgage. Once we come out of this recession and the economy starts to improve, rates will increase and we may never see these low rates again for many decades to come. It could be time to lock in for 5, 7 or even 10 years at the current rates to take advantage of these all time low mortgage interest rates

Thanks

Mark

Monday, December 28, 2009

US Housing Market has reached bottom!

Bottom Reached in Housing

U.S. home sales got a lift from the government’s first-time homebuyers’ tax credit and record low mortgage rates.

Sales of both new and existing homes are running 31% higher than their recent low, albeit 25% slower than their peak pace.

This increase combined with sharply lower housing starts has reduced the inventory of unsold homes significantly. Price increases so far have been limited, with the average still about 20% lower than peak levels.

The outlook for real estate remains murky given the backlog of foreclosures and strong increases in the number of homeowners who are delinquent in making their mortgage payments.

The government’s tax credit was extended until the end of April and the base of those who qualify broadened out. With interest rates remaining low, we expect that the pace of activity will gradually pick up but expect a relatively tame recovery for this sector during the forecast period.

I hope this finds you Happy and Healthy!

All the Best!

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

Thinking of Selling? Best Mortgage Rates Current Home Prices Search MLS Newsletter

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

( BUS 905-828-3434

2 FAX 905-828-2829 ÈCELL 416-520-1577

› E-MAIL : mailto:mark@mississauga4sale.com?subject=Mississauga

Website : Mississauga4Sale.com

- Thinking of selling your home in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

- Power of Sales and Foreclosures

- If you have not already signed up to receive my monthly real estate newsletter, you may do so here: On-Line Real Estate Newsletter sign up

- See seasonal housing patterns

- Would you like me to send you a 2010 Calendar?

Sunday, December 27, 2009

2010 is shaping up to be a great year, from RBC

2010 may be a great year, hold on for the ride.

Enjoy the article below.

Mark

New beginnings

Turning the page on 2009 will be done with great relief almost everywhere in Canada. The past year has been, by far, the toughest since the early 1990s recession and, in some cases, the early 1980s recession. Hardship was evident from coast to coast, even in parts of the country, such as Alberta, that were previously considered almost bullet-proof.

Perhaps more importantly, however, will be the full force of fiscal and monetary stimulus kicking in. Nearly all governments at the federal, provincial and municipal levels have initiated substantial infrastructure spending programs and these will be in high gear during the year ahead.

In most cases, although not all, 2010 will be the peak of stimulus spending.

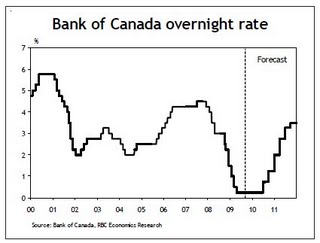

The easing of monetary policy is already having a visible impact – most notably in housing resale markets across the country – and should continue to do so despite our expectation that the Bank of Canada will gradually take its feet off the gas pedal starting mid-year. Extremely low mortgage rates have been key to the spectacular rebound in housing resale activity in every province since early 2009.

The precipitous decline in activity that started late in 2008 plunged a number of provinces – including Ontario, Alberta and British Columbia – into a deep slump through the better part of the year, which reverberated loudly in regional job markets.

The ranks of the unemployed swelled and unemployment rates surged broadly, reaching the highest levels since the 1990s in Ontario and Alberta.

While many challenges will remain, 2010 promises a widespread turnaround in economic performance, albeit a modest one at first. A more sanguine global context will sharply contrast with the meltdown on the world stage that took place in 2008 and early 2009. With the financial crisis behind us and the U.S. economy on the mend, factors “external” to the provincial economies are expected to contribute positively to growth again.

In turn, this housing resurgence should be seen as evidence that consumers are feeling more upbeat even in areas of the country such as British Columbia, Ontario and Alberta where the recession caused substantial damage.

The price tag for the fiscal stimulus is enormous – huge budget deficits.

Collectively, the provinces are projecting shortfalls totaling $38.2 billion in the 2009-10 fiscal year and at least $30.2 billion in 2010-11 (with two provinces not providing estimates), both records in terms of value. However, relative to GDP, the deficits will be modestly milder than the peaks recorded in the early 1990s.

While running up huge budget shortfalls might cause some discomfort, the alternative was even less attractive given the severity of the economic downturn. Nonetheless, returning to balance during the medium-term will be a challenge involving difficult choices. ECONOMICS I RESEARCH

In this update, there is little change to the big picture from our September Provincial Outlook: the contraction in activity is still seen to be widely spread in 2009 among provinces (with Manitoba and Nova Scotia the only exceptions)and the expected recovery to be equally generalized in 2010.

On the upside, there have been some upward revisions to New Brunswick and Nova Scotia in both 2009 and 2010 (Nova Scotia is now projected to be flat in 2009), and Quebec and Manitoba in 2009.

In this report, we are also introducing forecasts for 2011, which generally depict provincial economies strengthening further. The western part of the country – led by Saskatchewan – is generally expected to grow faster than the national

average of 3.9% with the exception of British Columbia, which will be feeling some post-Olympics moderation.

However, we have made minor revisions to some provincial forecasts. The most significant change has been for Newfoundland & Labrador, where longer-than-expected production shutdowns in the mining sector have prompted us to deepen the real GDP decline in 2009 by one percentage point to 4.5% and to bump up growth slightly in 2010 to 2.4% from 2%.

Smaller downward revisions have also been made to Alberta (to reflect weaker-than-expected momentum at this stage) in both 2009 and 2010, Saskatchewan in 2009 (in light of the dramatic drop in potash production) and Ontario in 2009 and 2010 (a larger-than-expected decline in the second quarter of 2009 and slightly more subdued recovery in 2010).

I hope this finds you Happy and Healthy!

All the Best!

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

Thinking of Selling? Best Mortgage Rates Current Home Prices Search MLS Newsletter

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

( BUS 905-828-3434

2 FAX 905-828-2829 ÈCELL 416-520-1577

› E-MAIL : mailto:mark@mississauga4sale.com?subject=Mississauga

Website : Mississauga4Sale.com

- Thinking of selling your home in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

- Power of Sales and Foreclosures

- If you have not already signed up to receive my monthly real estate newsletter, you may do so here: On-Line Real Estate Newsletter sign up

- See seasonal housing patterns

- Would you like me to send you a 2010 Calendar?

Wednesday, December 23, 2009

Is it Time to Lock into Long term mortgage interest rates?

The answer depends upon many factors including your ability to tolerate risk.

I've written many times in the past that the best route was to go short term on your mortgage, for at least the past 20 years or so. Mortgage rates are predicted to increase beginning about the middle of 2010 and some are predicting that the Bank of Canada will increase the prime rate by as much as 2.75% over the period from the middle of 2010 to the end of 2011 If this happens, then it's likely mortgage interest rates will also increase by about the same or even more than 3% over the same period.

This would indicate with almost certainty that you should lock into long term mortgages. BUT, this is not necessarily true. Read more at this link

http://www.mississauga4sale.com/Lock-In-Short-Term-Long-Term-Mortgage.htm#update2009

I wish you and your family a Merry Christmas and all the best in the New Year!

Mark

Monday, December 21, 2009

Wishing You and Yours a Merry Christmas!

Drawn by Haddon Sundblom in 1949

Friday, December 18, 2009

RBC reports that the US economy has also turned the corner

Mark

U.S. Economy Turns the Corner

The U.S. economy grew at a 2.8% annualized pace in the third quarter, marking the first increase in real GDP after a year of quarterly declines.

Some of the increase was directly attributable to the government’s Car Allowance Rebate System (also known as the cash for clunkers program), which bolstered spending on autos in the quarter.

The strong pace of auto purchases will likely not be sustained in upcoming quarters; however, retail activity continued to firm up in October and November, suggesting that consumers have come out of hiding.

I hope this finds you Happy and Healthy!

All the Best!

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

Thinking of Selling? Best Mortgage Rates Current Home Prices Search MLS Newsletter

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

( BUS 905-828-3434

2 FAX 905-828-2829 ÈCELL 416-520-1577

› E-MAIL : mailto:mark@mississauga4sale.com?subject=Mississauga

Website : Mississauga4Sale.com

- Thinking of selling your home in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

- Power of Sales and Foreclosures

- If you have not already signed up to receive my monthly real estate newsletter, you may do so here: On-Line Real Estate Newsletter sign up

- See seasonal housing patterns

- Would you like me to send you a 2010 Calendar?

Monday, December 14, 2009

RBC reports Canada at the end of the great recession

This is the latest from the RBC on our recession, or at least the end of it. This should come as good news. It's been about 14 months since our market entered the recession

The end of the great recession

Through the ups and downs in the economic numbers, one point is becoming increasingly clear — the great recession of 2008-2009 has come to an end. Most major economies we track have posted at least one positive quarterly growth rate with the lone holdout — the United Kingdom — posting another decline in the third quarter but on course to post a decent-sized gain in the final quarter.

However, the recovery so far has come in on the soft side as the unravelling of financial market leverage continues and economies grapple with high levels of unemployment. The enormous amount of stimulus coming from low interest rates and government spending will support an increase in momentum in 2010 but untillabour market conditions improve, central banks are likely to keep

conditions very accommodative.

I hope this finds you Happy and Healthy!

All the Best!

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

Thinking of Selling? Best Mortgage Rates Current Home Prices Search MLS Newsletter

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

( BUS 905-828-3434

2 FAX 905-828-2829 ÈCELL 416-520-1577

› E-MAIL : mailto:mark@mississauga4sale.com?subject=Mississauga

Website : Mississauga4Sale.com

- Thinking of selling your home in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

- Power of Sales and Foreclosures

- If you have not already signed up to receive my monthly real estate newsletter, you may do so here: On-Line Real Estate Newsletter sign up

- See seasonal housing patterns

- Would you like me to send you a 2010 Calendar?

Thursday, December 10, 2009

Costs for Real Estate License in Ontario

I have a few sections on my website that will give details about licensure and the first section if about costs associated with getting your license, it's about the same anywhere in Ontario.

These are the 7 Tips for long term success in the real estate business in Ontario

These are the Ten specific Tasks that leading real estate salespeople do to succeed in real estate

Once you have read through these pages, I would be happy to answer any questions you may have.

Here is some information on motivation and universal success secrets

A. Mark Argentino, P.Eng., Broker

RE/MAX Realty Specialists Inc.

Bus: 905-828-3434

email: mark@mississauga4sale.com

web: www.Mississauga4Sale.com

Saturday, December 05, 2009

Fixtures and chattels Agreement of Purchase and Sale Residential Real Estate

Traditionally buyers get five basic chattels and all the home fixtures when buying residential homes. Lately we have noticed a shift from this trend as sellers now either sell with less or sell with a different set from that with which they staged.

Accordingly we must now pay great attention to what is included or excluded in the chattels and fixtures on the agreement of purchase and sale.

When acting for either party, to ensure clarity of the agreement, it is prudent to not only exclude any fixtures that have been agreed to be excluded but to do so in as much detail as reasonably possible and to also include in as much detail as can be gathered the chattels that are included.

For example using Schedule A of the OREA form of Agreement of Purchase and

“Chattels included: The refrigerator in the wet bar being a white Kenmore serial # ______________, the refrigerator in the kitchen being a black Frigidaire serial # ___________, the dishwasher in the kitchen being a black Whirlpool serial #______________, the washer and dryer in the laundry room being stacked white Kenmore series with serial #’s ____________ and _________ respectively and the stove in the kitchen being a black Kenmore serial #_____________.

Fixtures Excluded: the dining room chandelier described as a tear drops crystal glass design, the green Alde shrub outside the master bedroom window aged approximately ___________ , and the glass on the family room fire place”

At first glance this clause may appear overloaded with information but as staging is becoming more and more popular buyers are becoming more wary and prone to assume substations in agreed inclusions. This detailed description gives the buyer comfort that he/she got what was bargained for and the detailed exclusion ensures that the buyer is aware of fixtures that do not form part of the agreement.

Remember to reinforce the golden rule to both parties always:

Fixtures stay unless you exclude them and chattels go unless you include them!

I hope this finds you Happy and Healthy!

All the Best!

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

Thinking of Selling? Best Mortgage Rates Current Home Prices Search MLS Newsletter

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

( BUS 905-828-3434

2 FAX 905-828-2829 ÈCELL 416-520-1577

› E-MAIL : mailto:mark@mississauga4sale.com?subject=Mississauga

Website : Mississauga4Sale.com

- Thinking of selling your home in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

- Power of Sales and Foreclosures

- If you have not already signed up to receive my monthly real estate newsletter, you may do so here: On-Line Real Estate Newsletter sign up

- See seasonal housing patterns

- Would you like me to send you a 2009 Calendar?

Thursday, December 03, 2009

Facts about Dubai's debt problems

Here are some interesting facts on Dubai's debt

Property prices in Dubai are half of what they were a couple of years ago

Enjoy!

Mark

Ben Thompson, business reporter, DubaiFinancial markets and businesses are closed here for the Eid holiday - some suggest that's why the announcement was made when it was.

It's sparked real shock that things have come to this. Just 12 months ago, few could have believed the city would find itself asking for this lifeline.

It seems Dubai is now paying the price for living on borrowed money.Of course, everyone knew the boom couldn't last forever, but no-one expected it to collapse when, or as suddenly, as it did.

Property prices have more than halved over the past year and investors have fled.The official figure for Dubai's debt is $80bn, but talk to anyone here and the feeling is the figure is much higher. Unpaid bills, abandoned cars and empty buildings are all too obvious. Some analysts put the real figure at close to $160bn.

Wow!

Mark

Wednesday, December 02, 2009

3, 4, 5, 7 & 10 FIXED RATES HAVE DROPPED

Effective December 1, 2009*

| Term | 6 Month | 1 Year | 2 Year | 3 Year | 5 Year | 10 Year | Var Rate | Prime Rate | ||

| Posted Rates | 5.10% | 4.10% | 4.25% | 5.05% | 5.85% | 6.90% | ||||

| Best Rates | 4.59% | 2.75% | 3.05% | 3.49% | 3.99% | 5.34% | 2.15% | 2.25% |

GREAT NEWS!!

3, 4, 5, 7 & 10 FIXED RATES HAVE DROPPED

ALSO---VRM rate is now 2.15%...( P-.10% )

see the current rates:

http://www.mississauga4sale.com/Rates-Current-Posted-Mortage-Interest-Rate.htm

I hope this finds you Happy and Healthy!

All the Best!

Mark

A. Mark Argentino

P. Eng. Broker

Specializing in Residential & Investment Real Estate

Thinking of Selling? Best Mortgage Rates Current Home Prices Search MLS Newsletter

RE/MAX Realty Specialists Inc.

Providing Full-Time Professional Real Estate Services since 1987

( BUS 905-828-3434

2 FAX 905-828-2829 ÈCELL 416-520-1577

› E-MAIL : mailto:mark@mississauga4sale.com?subject=Mississauga

Website : Mississauga4Sale.com

- Thinking of selling your home in the next 3 to 6 months? Would you like a Complimentary & Quick Over-The-Net Home Evaluation ?

- Power of Sales and Foreclosures

- If you have not already signed up to receive my monthly real estate newsletter, you may do so here: On-Line Real Estate Newsletter sign up

- See seasonal housing patterns

- Would you like me to send you a 2009 Calendar?

Monday, November 30, 2009

GNOUI and GOLD on the world markets

to the world markets

Enjoy!

Mark

GNOUI simply translates into:

Golden Nuggets Of Useless Information.

#1 For folks who might not know, all the gold that's ever been found would

fit into two Olympic-size swimming pools. Including the 200 M. Tonnes that

India bought, the purchase from Sri Lank and the $70 Millions or 2 M. Tonnes

that Mauritius bought last week. There is expected to be a fourth buyer this

week. It seems that the Central Banks are slowly converting back to the Gold

Standard.

Quote from Bill Fleckenstein / Today's Gold Market.

And that's sad. We think of having a couple of 5 or 10 oz. bars, some wafers

and maybe some gold coins, wherein, we actually have so little in comparison

to the total, that if we dropped it into the pile, no one would ever know.

Maybe Goldfinger was not so wrong after all.

.